B.C.'s labour market regained momentum in October with 14,900 more individuals reported to be working relative to September, marking a 0.6% increase. After a two-month pause, hiring was the strongest among provinces and outperformed a 0.2% national gain.

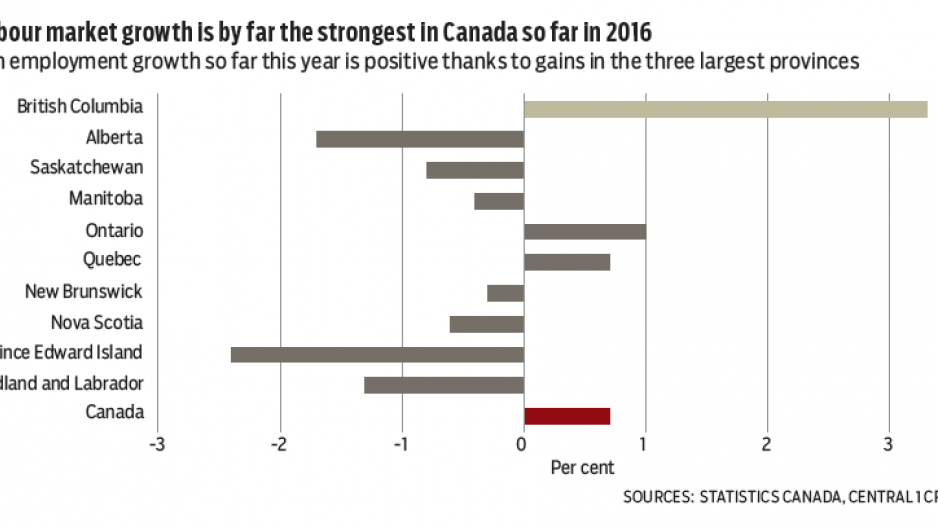

Despite some deceleration, year-over-year employment growth remained strong at 2.4% in October, led by regions outside Metro Vancouver. This remained well above all other provinces and contributed to a year-to-date gain of 3% compared to 0.6% nationally. B.C.’s unemployment rate jumped half a point to 6.2%, but remained the lowest in the country, while the uplift reflected rising population and a higher labour-force participation rate – both positive reflections of economic growth.

Below the surface the employment story was broadly positive with a 0.5% rebound in full-time jobs, and contributions from the part-time sector. While full-time gains have slowed since mid-year, year-to-date growth remained a healthy 2%, with part-time gains up 7.6% over the period. Services-producing sectors, particularly public administration, finance/insurance and building and support services, alongside construction, remain key pillars of growth.

Regional differences should be emphasized. The Lower Mainland and Vancouver Island economies continue to drive higher employment growth and lower unemployment, benefiting from a strong building cycle, tourism, other service-oriented gains and population growth in the Lower Mainland and Vancouver Island, while the rest of the labour market has struggled with low commodity prices and the impact of the Alberta recession on the interprovincial labour market.

Meanwhile, goods exports to international markets in September gained further momentum after a subdued spring. Dollar-volume sales growth accelerated to 7.8% year-over-year, up from a 5.4% pace in August. Drivers included products of the forestry, mining and energy sectors. Seasonally adjusted, exports rose 3.7% from August.

While monthly fluctuations in exports are the norm, B.C. exports have gained momentum. Year-to-date dollar-volume exports climbed to a modest 2.7%, but we estimate real physical shipment growth of 6% to 7%. Lower dollar-volume sales have reflected commodity prices.

A low Canadian dollar is contributing to a broad lift, but forestry growth reflects a 15% surge in softwood lumber shipments coinciding with the end of the softwood lumber agreement and subsequent grace period for negotiation that essentially allowed free access to the U.S. market. •

Bryan Yu is senior economist at Central 1 Credit Union.