You've listened to your financial adviser, saved diligently, invested wisely and now, with retirement looming, you’ve got a million dollars to draw on.

Time to start living like a millionaire, right?

Not so fast, grandma. That money has to carry you for another 20 or 30 years. For at least the first decade or decade and a half of your post-work life, you risk outliving your money if you tap into the principal amount.

That means living off the annual returns your nest egg generates – such as interest, dividends and capital gains. Add in the Canada Pension Plan (CPP) and any company or employee pensions, and you’ll have a fair idea of how much you’ll have to live on. Advisers generally suggest a target of between 40 per cent and 80 per cent of your pre-retirement income – with the final amount determined by several factors.

“Each person is going to have a different number regardless of how much they have saved,” explains David Bassett, a vice-president and investment adviser with TD Wealth. “The notion of what’s enough to live on is going to be based on your lifestyle, but it’s also going to be determined by the age you expect to live to.”

It’s also based on the nature of your investments. A balanced portfolio of stocks and bonds returning five per cent on $1 million produces $50,000 a year – an amount Bassett describes as “a little bit bracing” for someone accustomed to an executive-grade salary. Even more “bracing” is the return on $1 million at two per cent – $20,000 a year, which is roughly the annual return in 2015 on a cautious investment solely in guaranteed investment certificates.

You’ll have to decide how much risk you can tolerate, and how much you’re prepared to adjust your lifestyle. The good news is that for someone who has been dutifully setting aside 10 per cent of his or her income for a few decades, the adjustment to a retirement income is less of a challenge.

“If you’ve been saving 10 per cent all the way through your working life, then at least you’ve developed spending habits that are within your means,” Bassett says.

“If one person is making $200,000 a year and another makes $50,000, people wonder how it can work out for someone making the lesser amount. If you are always putting away 10 per cent for savings, you’ve learned to live on the balance. The sooner you start that savings habit, the better.”

Bassett recommends waiting until you’re at least 75 before you start touching your principal investments.

Aside from deciding your lifestyle and investment preferences, KCM Wealth Management president Adrian Mastracci recommends a conservative approach when calculating other benefits that contribute to your income.

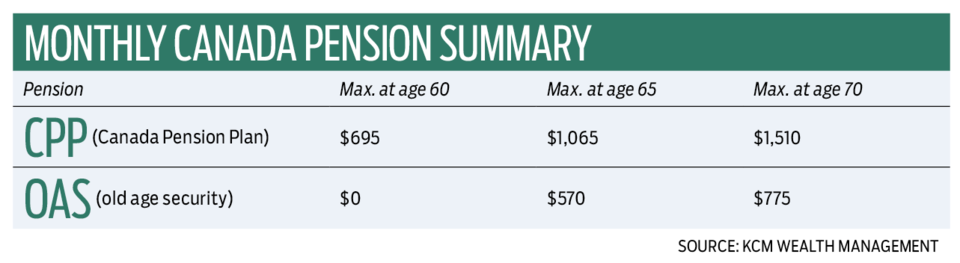

For example, although the annual maximum combined benefit from CPP and old age security (OAS) is close to $20,000, “most people probably don’t get 100 per cent of both.” Mastracci recommends assuming you’ll get 75 per cent of those government benefits, which are tied to the cost of living – and he suggests deferring them for a few years if you can afford it because the payments increase for every year you delay.

“CPP at age 65 is $1,065 per month maximum. If you defer for five years it goes to $1,510 per month. OAS is $570 per month at 65, and it goes to $775 if you defer for five years. You get a much bigger number, and the good thing is the indexing starts at the big number.”

There is “no specific amount” of retirement income, Mastracci says. “The questions to ask yourself are: how much do I need, how much saving will it take to achieve that, is it realistic, and how do I achieve that?

“What you need to do is handle all of your expenses and then have a little bit more. Hopefully you don’t have a mortgage. But you have property taxes, insurance, food, going out, travel and what have you. Income is secondary after you figure out expenses because if you can’t make the expenses, something has to give. Usually it’s a cutback on travel, or food, or entertainment, or helping out the kids.”

One final tip, from David Lee of BlueShore Financial, is that “you will likely spend more in the first few years of retirement, because you’re excited and you’re healthy. After that, re-evaluate.”

For more on retirement preparedness, see an infographic at www.biv.com/navigating and read our new Retirement Ready magazine at https://www.biv.com/magazine/retirement-ready-2016/