B.C.'s labour market saw little change in November with a steady employment count and unemployment rate that were good enough to outperform the rest of the country.

The latest estimates from Statistics Canada’s Labour Force Survey showed a mild and insignificant decline in B.C. employment of 0.1% from October, representing about 1,400 persons. In comparison, Canadian employment fell by 0.2%, led by significant contractions in Alberta, Manitoba and the Atlantic provinces. Unemployment in B.C. edged slightly lower to 6.2% of the labour force due to a dip in participation rate, compared with a national rate of 7.1%.

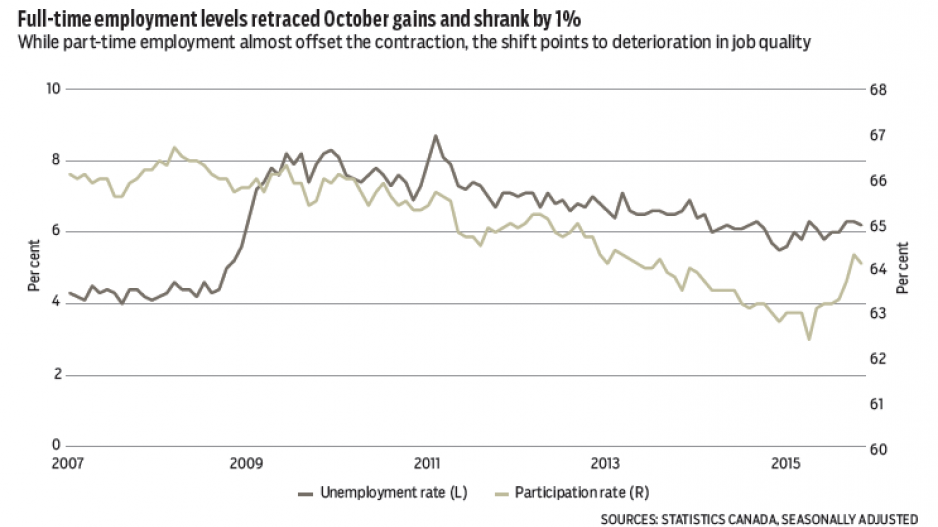

While B.C.’s employment numbers compared favourably to the rest of the country in November, the details were still a mixed bag. Full-time employment levels completely retraced October gains and fell by 1%. While part-time employment almost fully offset the contraction, this shift suggests deterioration in job quality and possibly income as some full-time employees may have observed cuts in hours during the month. Younger workers (aged 15 to 24) fared worse, with employment contracting 1.6%, while edging slightly higher for the rest of the population.

Among industries, significant monthly growth in goods-producing sectors was offset by contraction in service-sector jobs. The most significant gainers included agriculture (25%/5,300 jobs) and manufacturing (3.7%/6,500 jobs), which more than offset a drop in resource extraction (-4.2%/2,100 jobs). On the services-producing front, B.C. experienced significant declines in trade (-1.8%/6,500 jobs), finance, insurance, and real estate (-6.8%/8,700 jobs). Management support services and transportation and warehousing provided some offset.

Monthly labour market estimates, particularly at the more detailed industry level, are prone to significant monthly volatility. Nonetheless, the key takeaway from November is that B.C.’s labour market continues to improve. Year-over-year employment growth of 2.6% leads the country, extends a period of stronger momentum extending back to May and dovetails well with signs of moderate economic growth among other indicators including retail sales, housing, and tourism. However, one source of weakness is the resource sector, which has shed jobs due to weak mining and natural gas conditions within the province, and low oil prices that are affecting B.C. residents who commute to the Athabasca oilsands.

These trends have led to regional labour market differences. Although year-to-date employment growth sits at 1.1%, Metro Vancouver is clearly B.C.’s jobs engine. Year-over-year employment growth in Metro Vancouver of 4.2% has contributed to a 1.5% year-to-date regional gain.