The lure of Hogtown finally became irresistible to one of the last holdouts among large Vancouver-based wealth management companies.

Leith Wheeler CEO Jim Gilliland told Business in Vancouver February 29 that his 34-year-old firm hired investment-management veteran Marcel Leroux last fall and opened a Toronto office in late February.

The news comes several years after Nicola Wealth Management opened a Toronto office.

It also comes amid a growing consensus in the local wealth management sector that, although money can be managed in the country’s most remote locations, there’s no substitute for having investment advisers’ wingtip shoes on the ground in the cities where their clients live.

“We’re frequently on the plane to go meet our clients,” Gilliland said. “Having an office in Toronto will allow us to do a better job of serving our clients there.”

Leith Wheeler continues to base approximately 70 staff in Vancouver and another five at its five-year-old Calgary office. Gilliland expects that the Toronto office could grow to five employees within the next few years, but he stressed that the firm’s centre of gravity will remain Vancouver.

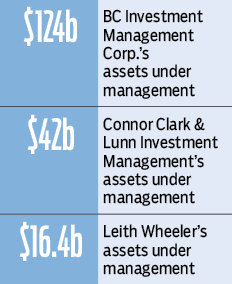

British Columbia Investment Management Corp. is arguably the largest Vancouver-based wealth manager, given its $124 billion under management, but its business model is tilted toward public-sector institutions such as pension funds and the WorkSafeBC accident fund. It’s therefore a fundamentally different business from Leith Wheeler and others, such as Connor Clark & Lunn Investment Management Ltd. (CCL).

With about $16.4 billion under management, Leith Wheeler ranks second among Vancouver-based wealth management companies that have sizable businesses managing money for individuals and private institutions.

CCL would be the biggest of those companies, with about $42 billion under management, said CCL co-founder Larry Lunn.

He added that the Toronto-based Connor Clark & Lunn Financial Group has a “significant stake” in CCL but does not control it. CCL is controlled by its 22 Vancouver-based partners, even though a strong Toronto influence has always been at the company.

When Lunn launched CCL and became its managing partner in 1982, he had financial support from Toronto-based Gerald Connor and John Clark.

Lunn based the company in Vancouver for two reasons.

“One was because I wanted to live in Vancouver for personal lifestyle reasons,” he said. “The other was because there weren’t a lot of money-management firms [in Vancouver], while in Toronto the market was crowded.”

Success followed through the decades, and Lunn, similarly, has no plans to move his 34-year-old company’s base even as Vancouver real estate soars and political pundits speculate that top talent is leaving the city because it’s too expensive.

“We’ve found that being in Vancouver is attractive and recruiting is not an issue,” Lunn said. “We’ve hired people out of London, England, and New York. They come here because the lifestyle is attractive for them.”

John Nicola, who founded and is CEO of Vancouver’s third-largest wealth management firm for individuals, also has no plans to move his company’s head office.

Nicola’s firm’s assets under management, at about $4 billion, are a shadow of the other large Vancouver wealth management companies.

Growth, however, has been significant.

Nicola estimated that his 22-year-old company has increased its revenue and assets under management by roughly 22% compounded since 2000.

Last year those metrics rose by more than 30%, he said.

In addition to its two-year-old Toronto office, the firm has offices in the Okanagan and in Richmond.

“We have long had Ontario clients and an Ontario business – about 75% to 80% of our Ontario clients are within driving distance of Toronto,” said Nicola, who is hiring staff in Toronto. “So we asked, ‘If we had an office in Toronto, would it lead to faster growth?’” •