This month’s real estate headlines will likely be dominated by a plunge in Alberta housing demand as the dominoes fall from the oil price collapse, capital expenditure cuts and severe bruising of corporate Calgary.

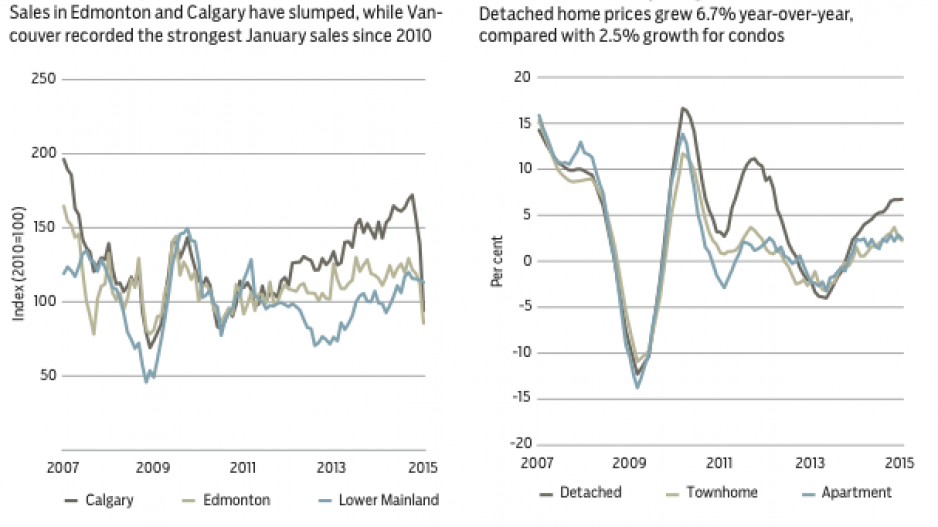

The souring of confidence and increased labour market uncertainty have understandably moved buyers to the sidelines in droves, while listings have ballooned as buyers assess the impact on housing prices. Alberta’s major real estate boards have reported year-over-year Multiple Listing Service (MLS) sales declines of 40% in Calgary and 26% in Edmonton.

While numbers for Alberta are dismal, there has been little negative feed-through to other large urban markets. After all, lower energy prices and, more recently, cuts to interest rates are a boon for households in most other regions of the country. Early-month figures from Toronto and the Vancouver area show year-over-year gains in sales, suggesting mild direct impacts.

In the Lower Mainland, MLS sales eased for a fourth consecutive month, but were not far from the highs observed last year and remained up from January 2014. Total MLS sales reached a seasonally adjusted 4,300 units, which was down 1.5% from December, with unadjusted sales up 8.5% from a year ago. This was the strongest January sales performance since 2010.

January’s solid sales activity, along with a mild new-listings pace, continues to support seller’s-market conditions.Unadjusted for seasonal variation, the benchmark home price climbed to $569,300 in January, 4.6% higher than a year ago. Year-over-year growth was led by a 6.7% gain in detached prices; multi-family prices were up about 2.5%.

Recent economic developments are positive overall for the Lower Mainland housing market. Pessimism over the Canadian economy and the recent Bank of Canada rate cut (with potentially another to come) have lowered bond yields and led to cuts to variable and fixed-term mortgage rates, enhancing affordability for homebuyers. Variable rates have not matched cuts to the Bank of Canada rate as traditionally is the case, but have fallen about 15 basis points.

Meanwhile, lower energy prices are allowing households to re-allocate money to other goods and services. These factors, along with moderate population and economic growth, are anticipated to lift sales by 6% this year to nearly 52,000 units, with the benchmark price climbing about 4% to $580,000.

Bryan Yu is senior economist at Central 1 Credit Union.