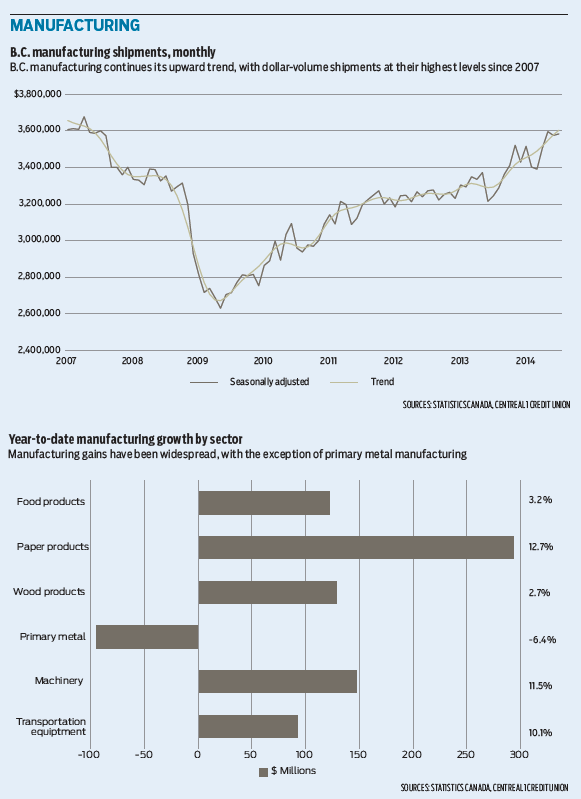

Growth in B.C. manufacturing shipments showed signs of stalling at mid-year, but the trend remained positive and overall activity remained elevated and consistent with an ongoing recovery in the broader export sector.

Total manufacturing sales held steady in July, gaining 0.2%, following a 0.6% drop in June.

Nonetheless, dollar-volume shipments held near their highest levels since 2007 at $3.58 billion (seasonally

adjusted) and were up 10% from the same month in 2013.

Upward momentum has contributed to a 6.3% gain in year-to-date sales through July.

While there are variations in sub-sector performances and some limited availability of data, manufacturing gains have been widespread.

The most significant contributors were related to paper, manufacturing, agriculture and solid-wood product manufacturing.

In contrast, primary metal manufacturing shipments lagged.

The pattern of growth is consistent with improvements in the U.S. economy and the housing market in particular, which lifts demand for wood products from regions such as B.C. Meanwhile, an underwhelming performance in emerging markets continues to weigh on the metals sectors.

B.C. manufacturers can look forward to rising sales over the next few years.

A period of moderated but sustained U.S. economic growth will underpin a positive export growth cycle in Canada.

Meanwhile, we can expect the Canadian dollar to remain highly favourable for producers.

Central 1 expects the dollar to fall to the $0.87 range over the next few years, which will provide a competitive edge for manufacturers north of the border that should drive growth in overall manufacturing production and sales. •