According to the latest job market statistics out of Statistics Canada’s Labour Force Survey (LFS), B.C. posted an abysmal performance in April.

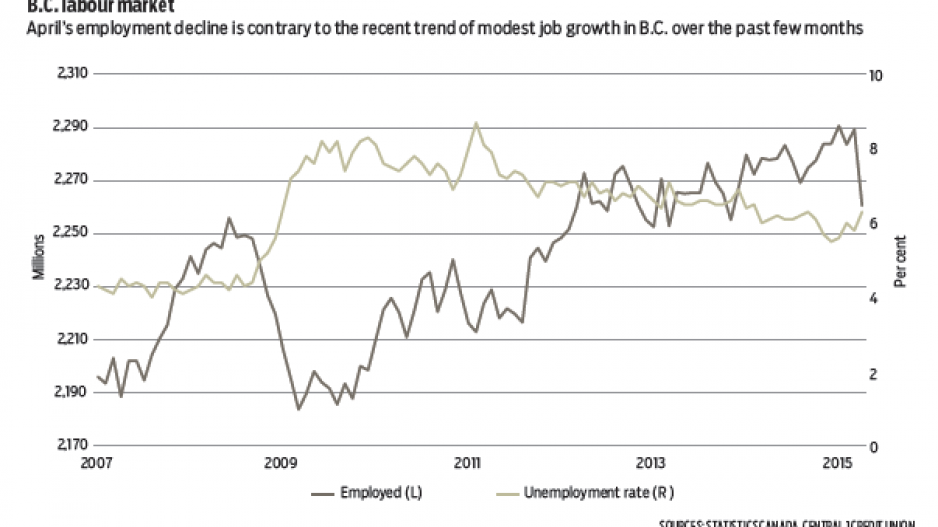

Estimated employment plunged by 28,700 persons or 1.3% from March. On a percentage basis, it was the sharpest drop since 2001. Absolute job losses were the highest on record going back to 1976. Declines were led by Metro Vancouver, which shed 19,800 jobs or 1.5%, compared with a 0.9% decline in employment in the rest of the province. Job losses pushed unemployment up by 0.5 percentage points to 6.3%. B.C. posted the weakest performance among provinces by far, while the national contraction was a mild 0.1%.

Given the magnitude of job loss in B.C., it’s not surprising that most details were negative. Full-time employment fell 1% from March, accounting for most of the top-line losses; part-time employment fell 2.3%. Youth and adult males bore most of the estimated losses, with the former contracting 2% and the latter 1.7%. Adult female employment eased by a more moderate 0.5%.

At the industry level, service-producing sectors accounted for the bulk of the decline. In particular, significant losses were recorded in professional/scientific/technical services (3.4%), education (5%) and information/culture/recreation (4.4%). Utilities also declined significantly from March (10.3%).

Given that top-line employment losses were statistically significant, some erosion in the labour market in April is likely, but the magnitude defies belief given the performance of other economic indicators. Housing starts/sales and building intentions are rising, retail activity is healthy, exports and manufacturing continue to improve, and tourism has climbed. Meanwhile, the magnitude of monthly industry losses is difficult to explain and doesn’t apppear to be tied to weakness in resource employment or the retail closures of Target and other stores, which weighed on previous months’ activity. Trade-sector declines in April were oriented towards wholesale rather than retail sectors.

Prior to the April plunge, the LFS employment trend was mildly positive. In short, take this month’s job losses with a grain of salt. A reversal of April employment losses is expected in May given a broadly positive economic environment. Average B.C. employment is forecast to rise by about 1% by year’s end. •

Bryan Yu is senior economist at Central 1 Credit Union.