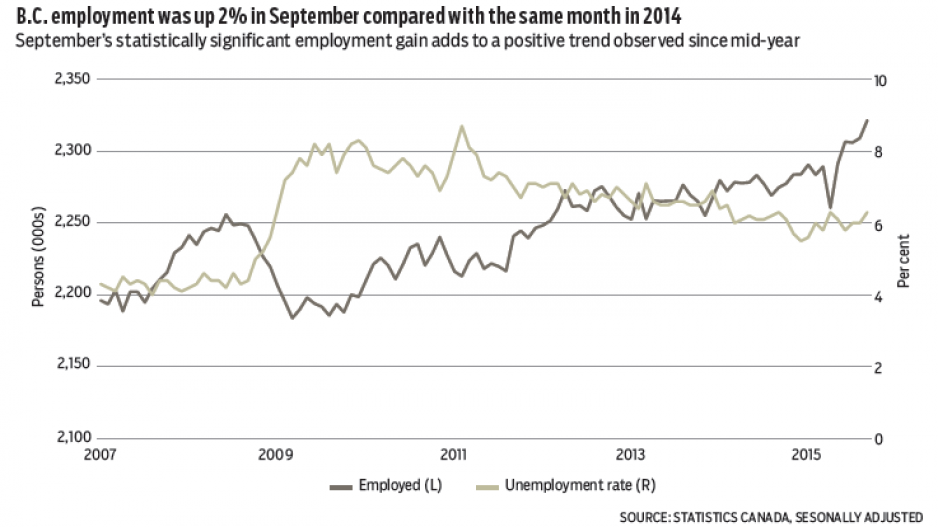

Break out the pumpkin latte – B.C.’s labour market showed more signs of improvement in September as estimated employment tracked higher for the fourth time in five months, leaving a weak first half in the rear-view mirror. According to the latest Labour Force Survey (LFS) estimates from Statistics Canada, B.C. employment climbed 0.5% or 12,400 jobs in September. This outpaced a national gain of 0.1%. Year-over-year, employment was up 2% from the same month in 2014.

September’s statistically significant employment gain adds to a positive trend observed since mid-year and essentially confirms what other indicators like housing, retail and exports have suggested – that B.C.’s economy and hiring momentum are improving. Meanwhile, the trend is moving more in line with the often forgotten Survey of Employment, Payroll and Hours, which has pointed to stronger hiring gains this year. For the most part, September’s LFS report was positive. Job quality improved as full-time employment continued to increase, rising 0.6% from August and 3% from a year ago. Part-time employment growth also added to overall gains. Over the past year, full-time employment has climbed while part-time tenure has contracted, suggesting employers are offering more stable jobs and adding hours to their workforce.

B.C. observed a sharp uplift in goods-producing sectors from August. Significant gains were recorded in agriculture (12.1%), construction (4.1%) and manufacturing (3.2%). The latter two posted strong same-month gains of about 7%.

While overall employment in the services-producing sector dropped, significant growth was observed in the information, culture and recreation sector (8.3%) and trade (1.6%). In contrast, the finance, insurance and real estate sector shrank 3% from August and was down nearly 8% from the same month in 2014.

Unemployment climbed to 6.3% from 6% in August. While this may be seen as a negative event, it largely reflects a rise in the labour force participation rate, which jumped 0.4 percentage points to 63.7%, the highest level since early 2014. A rise in participation could be interpreted as a signal of labour market confidence, as hiring momentum draws some out-of-work individuals back into the labour force to search for jobs.

Average employment growth is forecast to average a mild 0.7% this year, weighed down by a weak first half, before rising 1.4% in 2016.

Bryan Yu is senior economist at Central 1 Credit Union.