The cost of living in Vancouver is notoriously high compared with other Canadian cities, and while those working in the city are spending higher percentages of their incomes on day-to-day expenses, fewer are saving for retirement.

This is a serious problem, according to a Vancity report released February 13, which found that three out of four Vancouverites who are now under the age of 45 may be unable to retire if they don’t change their retirement savings strategies.

More than 75% of those surveyed in this demographic do not contribute anything at all to RRSPs. Among those that do put money into these investments, the average amount being put aside has fallen over the past several years.

“This lack of RRSP contributions will significantly impact this generation’s ability to maintain a viable standard of living into retirement,” said Vancity in the report.

In 2000, under-45s contributed an average of $1,494.23 to their RRSPs. By 2012, that amount had fallen by $271.75 to $1,222.48.

The percentage of Vancouver residents in this age category who made any contributions at all fell almost 10% over this period, from 33.9% in 2000 to 24.2%.

The story in Victoria is similar, with 77% of people under 45 not saving for retirement. Between 2000 and 2012, the number of those who made RRSP contributions fell more than 11% to $900.38.

Across the country, those under 45 contributed an average of $1,064.42 to their RRSPs in 2012. However, due to the inflated cost of living in Vancouver, the amount of income needed in retirement is higher than in other cities. Retirement, according to the study, will therefore come later for those in this city.

Many of those surveyed said they plan to rely on CPP and OAS in their retirement years. However, the report points out that these amounts are too low to live on ($7,300 and $6,700 per year, respectively.

One of the other ways many Canadians use to plan their retirement is through real estate, using their homes as part of their financial plans for the future. However, only 36% of Vancouverites and just over half of those in Victoria own their homes, putting this strategy out of reach for many.

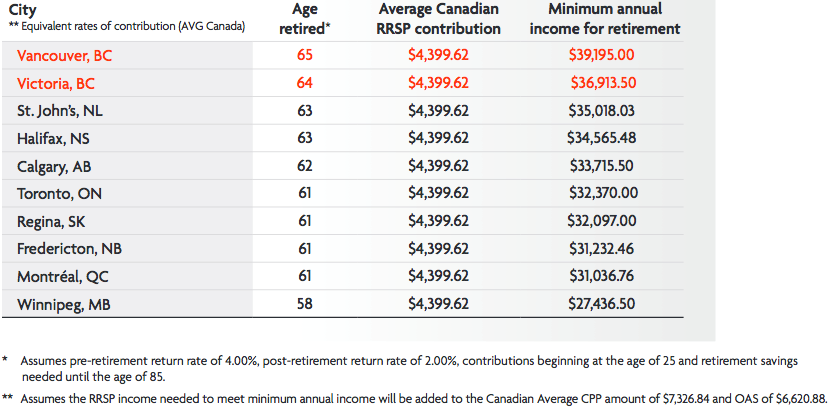

The minimum annual income for retirement, according to Vancity, differs significantly from city to city. In Vancouver, that amount is $39,195 per year. In Winnipeg, that figure falls to $27,437. Assuming an annual contribution beginning at age 25 of $4,400 – or $367 per month – Vancouverites would retire a full seven years later than those in Winnipeg.

Projected retirement age by city:

Source: Vancity