The sharp decline in oil prices in recent quarters and cuts to Alberta oilsands capital investment have led to questions about their potential effect on the B.C. labour market. In particular, what exposure does B.C. have due to B.C. residents working in Alberta, and which regions are more at risk?

Our view is that the effect will be small on B.C.’s overall economy and labour market, and geographically concentrated. A recent study from Statistics Canada on Canadian interprovincial employment supports our expectation that any associated job losses will have only minor effects on B.C.’s growth.However, additional data obtained by Central 1 Credit Union points to higher potential risks in the Thompson Okanagan and Kootenay regions.

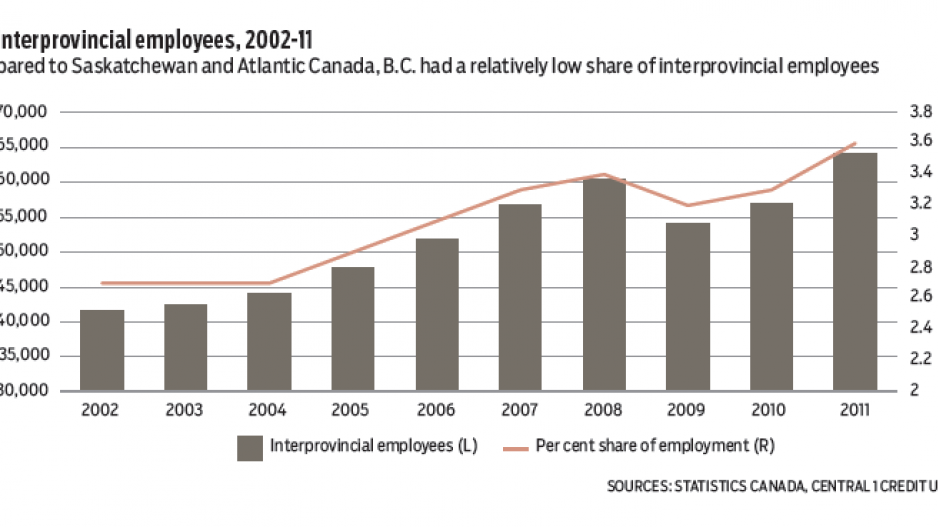

For the most part, the data supports the anecdotal information we have seen on flows of interprovincial employees (IPE). There were approximately 64,180 IPEs residing in B.C. in 2011, with the majority earning income from Alberta sources. IPEs are individuals who received at least some employment income from another province in a given tax year.

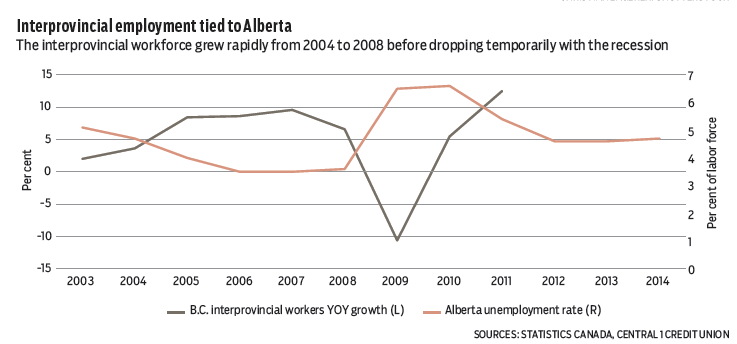

Income-by-source data suggests 60% of total interprovincial employment income was earned from Alberta employers during the year, with a further 21% from Ontario. Given this high share, it’s not surprising that labour market conditions in Alberta and the number of interprovincial workers from B.C. are positively correlated.

Stronger labour market conditions in Alberta increase employment flows from B.C. owing to more job opportunities and higher wages – even if not for permanent work.

The interprovincial workforce grew rapidly from 2004 through 2008, before receding temporarily following the recession.

It’s likely that B.C.’s IPE resident workforce continued to rise since 2011, given declining unemployment rates and stronger job growth in Alberta. Unemployment in Alberta fell to 4.7% last year compared to 6.1% in B.C., while employment growth reached 2.2% compared to only 0.6% in B.C.

From these trends, it’s safe to say that expected cuts to Alberta oil and gas capital expenditures will weigh on B.C. interprovincial employment.

The overall effect on B.C.’s economy of IPE losses is anticipated to be small given that interprovincial workers make up a relatively small share of total B.C. paid employment. Based on 2011 data, the ratio in B.C. was 3.6%.

In comparison, the effect on Saskatchewan and Atlantic Canada is expected to be deeper. The proportion of interprovincial workers among total employed individuals in Saskatchewan was close to 7%. Meanwhile, 10% of Newfoundland and Labrador’s paid employees worked outside the province.

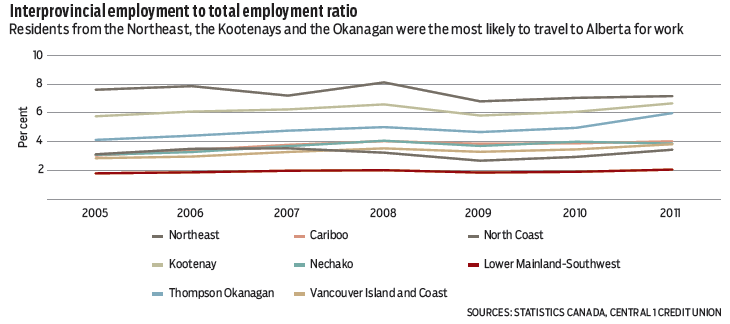

Within B.C., our estimate of IPE-to-total employment for 2009-11 was highest in the Kootenay (6.2%) and Northeast (7.0%) development regions, despite representing a small share of total interprovincial employees. IPEs also represent a high share of the regional employment base in the Thompson Okanagan at 5.2%, while the ratio was lowest in the Lower Mainland-Southwest at 1.9%.

These figures aren’t surprising and align well with anecdotal information from local discussions and media reports, and reflect economic and demographic factors. High ratios in northeast B.C. reflect the area’s proximity to similar energy-driven markets in northwestern Alberta. Labour is able to shift between markets depending on where opportunities and wage growth are stronger.

The effect of any losses due to cuts in Alberta will be limited by recent cuts to interest rates and related declines in the Canadian dollar, which will more than offset these IPE-related effects through increased local opportunities. •

Bryan Yu is senior economist at Central 1 Credit Union.