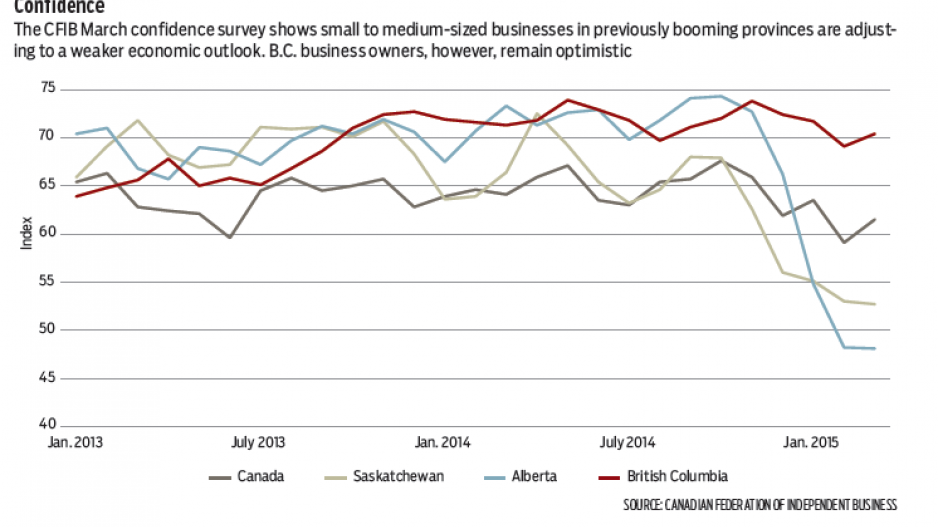

As we await official data to assess the oil rout’s damage on the economy, this week’s release of the Canadian Federation of Independent Business (CFIB) March business confidence survey suggests small to medium-sized businesses are already adapting to a softer economic environment and recalibrating their outlook for the coming year.

The CFIB survey provides evidence of a slowdown in Canadian economic growth and a clear divide between oil have and have-not economies. Countrywide, CFIB’s survey reading of 61.5 points suggests modest optimism, with the number of businesses expecting a stronger performance over the next year outnumbering those expecting a weaker performance. This was up slightly from February, but still down from the reading of more than 65 points before the most recent oil price plunge. A reading above 50 means that businesses with a positive outlook outnumber those with a negative outlook.

Not surprisingly, and in line with expectations for the economy, the deciding factor for confidence is exposure to oil. Confidence in Alberta, Saskatchewan, Newfoundland and Labrador and, to a lesser extent, Manitoba has dropped. The confidence reading is below 50 points in Alberta, as businesses are generally pessimistic on business performance over the next year. Prior to the drop in oil, and subsequent announcements of capital expenditure cuts and layoffs, Alberta confidence was the strongest in the country. Meanwhile, Saskatchewan and Manitoba are showing only mild net-positive expectations for performance.

In contrast, other provinces have generally held up well. Low oil prices and the flow-through to a weaker Canadian dollar, gas prices and interest rates are net benefits to non-oil-producing provinces and their residents.

In particular, confidence in B.C. continues to remain high despite a slight decline in recent months. At a reading of 70.4 points, B.C. confidence was the highest in the country in March.

Elevated business confidence coincides with recent readings of elevated retail sales, rising home sales and increasing levels of tourism, and aligns with our view that the oil decline is a net positive for the provincial economy. We forecast economic growth of 2.8% this year and 3.4% in 2016, with further rotation to the export economy. Confidence is a precondition for hiring, and according to the CFIB, intentions to hire full-time staff climbed sharply during the month to revisit some of the highest levels observed in recent years. We forecast employment growth of 1.4% this year following a gain of only 0.6% in 2014.•

Bryan Yu is senior economist at Central 1 Credit Union.