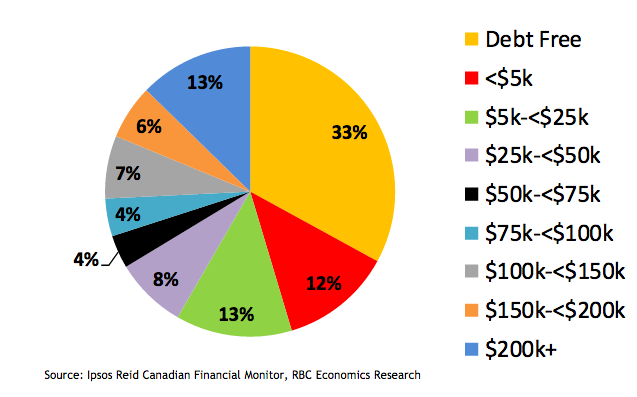

As well, 12% of households have less than $5,000 in debt, and 13% owe between $5,000 and $25,000, meaning almost half of all households have what RBC calls “little to no debt.”

On the flip side, 26% of all households carry debt worth more than $100,000, including 13% who owe more than $200,000.

Households with occupants over age 65 are carrying heavy debt loads, increasing the risk of retirement security challenges.. Among senior households, one in 10 households had debt in excess of $100,000 in 2016. The average household debt in this demographic was more than 30%, which is up from 10% in 1999 and around 13% in 2006. In 2016, lines of credit made up the majority of the increase in this category over the past decade; in 2016, 25% of households in this age group had secured lines of credit, compared with only 4% in 1999.

Image source: RBC’s Debt Dashboard, June 2017

“More than half of these credit lines are at variable rates, leaving this group exposed to interest rate increases at a time when incomes tend to fall due to retirement,” RBC said in its report.

RBC said if interest rates were to rise 100 basis points over the next year, the average household across Canada would have to allocate an additional 2% of its income to servicing debt.

@EmmaHampelBIV