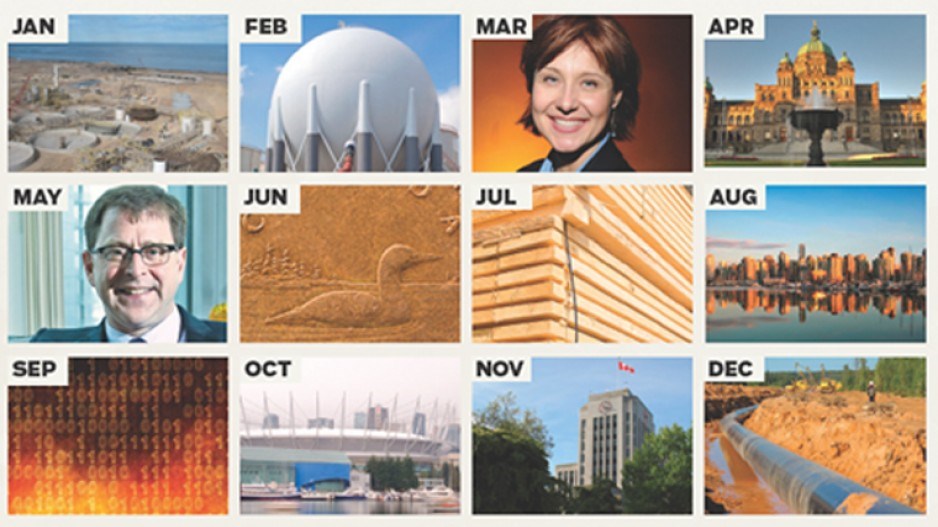

Canada's gateway to Asia is expected to benefit from improved economic conditions in key trading nations in the coming year, according to the latest forecasts from the country's leading economists.

Douglas Porter, deputy chief economist for BMO Capital Markets, is among the most optimistic about B.C.'s economy in 2013. He predicts the province's GDP growth rate will be 2.4%. His forecast is notably higher than the 1.8% increase predicted for the Canadian economy this year.

"It's been fairly typical that we have B.C. growing a bit above the national average, not just in the last year or two but for the last 10 years," he told Business in Vancouver on the sidelines of a BMO conference for advisers.

Forecasts from the other big-five banks and Central 1 Credit Union for B.C. GDP growth range between 1.9% and 2.3%. Warren Jestin, chief economist at Scotiabank, has a more subdued 2013 forecast for B.C.: 1.8%.

While even the most optimistic forecasts are sluggish compared with historical norms, most economists expected B.C.'s economy to improve this year and next based on an increased demand for key exports from the province's main international markets.

RBC noted the province should start to see the benefits of the federal government's eight-year, $8 billion order for seven non-combat ships being built by Vancouver's Seaspan Marine and the $3.3 billion upgrade of Rio Tinto-Alcan's aluminum smelter in Kitimat.

B.C.'s forestry sector is likely to continue to improve with increased lumber demand stemming from the emerging turnaround of the U.S. housing market. Lumber prices are approaching five-year highs, and Jestin said that the U.S. market "is going to surprise on the upside, so that could push prices even farther."

B.C.'s mining sector is also likely to rebound somewhat as demand for key base metals like copper is expected to increase with economic growth in China this year.

Porter noted that China's new leadership will likely implement some additional "moderate" stimulus measures to boost the domestic economy, after the country's outgoing leaders cut interest rates and increased credit availability.

But the country's exports are also likely to see a boost as U.S. economic growth accelerates in 2013 and 2014 as consumer confidence and spending edge up. Porter is forecasting the U.S. economy to grow faster than Canada's in 2012 and accelerate further this year.

Other key emerging markets are also likely to improve. Porter noted that countries like South Korea and Brazil have made a number of interest rate cuts in the past year to boost their economies, the impacts of which should start being felt this year.

All told, Scotiabank's Patricia Mohr is forecasting lumber prices to reach US$340 per thousand board feet (mfbm) in 2013. She's also forecasting average base metal prices including nickel, aluminum and zinc to rise and copper to stay at highly profitable levels this year.

A key drag on B.C.'s economy, however, will be its residential real estate market. After sales levels reaching decade lows, particularly in the Lower Mainland, most economists still expected the market correction to continue this year. TD is forecasting average home prices in B.C. to remain essentially flat over the next two years after falling nearly 10% in 2012. Population growth is also expected to be sluggish, according to Central 1, with interprovincial out-migration to continue and an increasing number of immigrants flocking to Alberta and Saskatchewan instead of B.C.

Added Jestin: "Canadians are now at a record home ownership situation with 70% of all households owning their homes versus renting. It's never been that high in Canada and that, by itself, provides less support than it did when the percentage was moving up from the low 60s."

Longer term, Porter remained confident that commodity prices will remain strong overall and won't fall to the same levels they were a decade ago prior to a commodity "super-cycle" that created a decade-long run up in prices.

Mohr expects most base metal commodity prices to remain solid as China's economy accelerates in 2014 and lumber prices will see a continued boost to US$375 mfbm.

For B.C., Jestin said the province is likely to benefit greatly from the emerging Asian market for B.C.-sourced liquefied natural gas.

Boosting provincial government revenue over the next few years will be key to maintaining the province's triple-A credit rating. In December, Moody's changed its outlook of the province to "negative" from "stable" because of the province's increasing debt levels and softening economic outlook.

Business in Vancouver asked business leaders from a cross-section of industry sectors: what will be 2013's key business issues and the year's biggest winners and loser

Jock Findlayson

Executive vice-president, Business Council of BC

The top three business/economic issues for 2013 in B.C will be:

- The return to the PST as the HST is dismantled. This will significantly erode B.C.'s competitive position across a wide range of sectors – including manufacturing, film production, telecommunications and resource processing.

- The recovery of the B.C. lumber industry, as U.S. housing starts rise and lumber prices strengthen further.

- The crystallization of the opportunity to develop a world-scale liquefied natural gas industry in British Columbia.

Iain Black

President and CEO, Vancouver Board of Trade

The top three issues for the B.C. economy in 2013 include progress on transit without visa and open skies, continued discipline from all levels of government in terms of spending, and enhanced clarity on our energy strategy as it relates to Alberta.

The biggest winners will be B.C. shipbuilding; Port Metro Vancouver and our goods movement sectors as the Port Mann and Highway 1 widening proves itself; and B.C. employers as we continue to benefit from an increased focus on skills training.

John Winter

President and CEO, B.C. Chamber of Commerce

The biggest winners and losers in 2013 in B.C. will be the people of B.C. We will be winners if we find a way quickly to take advantage of the billions of energy and transportation-related dollars about to be invested in our economy, and we will all be the losers if we do not. Key to this success will be our ability to overcome the shortage of skilled workers that are required to deliver on this promise.

Bill Tam

President and CEO, BCTIA

- U.S. rebound. The U.S. economy recovers, led by corporate spending. B.C. technology companies will be significant benefactors.

- Buy local. Canadian government champions government procurement; government and agencies will be inspired to buy B.C. tech.

- B.C. on global tech map. A multimillion-dollar tech innovation hub in Vancouver focused on growing mid-sized tech companies in B.C.

Howard Donaldson

President, DigiBC

- Battle for future economic growth and knowledge-based jobs as traditional businesses are disrupted by new technologies, social media and the digital economy.

- Proliferation of smart mobile devices (not just smartphones) and software applications. This trend will disrupt the traditional PC and desktop business.

- Cloud-based services and big data will offer new opportunities for customer engagement.

Michael Geller

president, Michael Geller and Associates Ltd.

Real estate in B.C. in 2013 is going to be influenced by:

- the perception of falling prices, whether they fall or not;

- increased community opposition to many developments, fuelled in part by social media; and

- uncertainty over whether international investment will continue.

Hani Lammam

vice-president of development and acquisitions, Cressey Development Group

Greater Vancouver real estate will continue to benefit from strong underlying fundamentals. Notwithstanding, the following issues will affect the real-estate market in 2013:

- the provincial election;

- oil pipeline and LNG proposals; and

- population growth.

The first two will establish whether B.C. will be pro- or anti-business, which will affect business and investor confidence. Population growth will determine the overall health of the residential real estate sector, which in turn drives consumer confidence.

Gavin Dirom

President and CEO, Association for Mineral Exploration BC

Some top issues for AME BC are:

- raising awareness of the socio-economic importance and benefits of mineral exploration to B.C.'s urban population;

- increasing dialogue about permitting, land access and use for grassroots mineral exploration in B.C. in advance of the election;

- developing the Canadian International Institute for Extractive Industries and Development led by UBC and SFU; and

- expanding the capacity building work of the BC Aboriginal Mine Training Association (BC AMTA) to train aboriginal workers.

Paul Kariya

Executive director, Clean Energy BC

B.C. is trying to secure LNG developments in Kitimat and Prince Rupert. If these are powered by clean and renewable energy, as Premier Christy Clark has indicated, the clean energy sector, First Nations and sensitive airsheds in the northwest could be winners. Decisions on the proportion of renewable and non-renewable fuels to be employed will be made in early 2013 by LNG companies with the BC Liberal government. An indication of NDP policy is expected in its election platform.

Dwight Yochim

Executive director, Truck Loggers Association

We see three issues as the keys to sustained growth in B.C's coastal forest sector.

- Harvest of the full allowable annual cut of coastal timber. This has great potential for employment growth in B.C. Over the past three years, we harvested only 85% of coastal timber supply.

- A stable financial environment that will allow the forest industry to reinvest, create jobs and recruit and train new employees.

- Ensuring market security and diversity, be it for logs, lumber or pulp.

Rick Jeffery

President and CEO, Coast Forest Products Association

For B.C.'s coast forest sector, the key issues for 2013 include:

- the outcome of the provincial election, because government policy affects everything;

- the shift back to the PST, which will affect investment in new technology and equipment; and

- the rebound in the global lumber market, which has the potential to benefit all British Columbians.

Bob Rennie

Owner, Rennie Marketing Systems

Here are three sets of winners and losers in 2013:

- Winner: Liberal Party.

- Loser: NDP.

- Winner: Public transit.

- Loser: The car.

- Winner in February 2013: Vancouver Art Gallery board if the Larwill Park big box $300 million-plus new art gallery model proceeds.

- Loser: Vancouver Art Gallery if the Larwill Park building proceeds.