B.C.’s see-saw pattern of employment growth continued into March. Following a pullback the previous month, Labour Force Survey (LFS) estimates of employment rose 0.2% from February to 2.29 million persons, a gain of 5,700. Employment growth was led by areas outside Metro Vancouver, which posted a 0.1% decline from February.

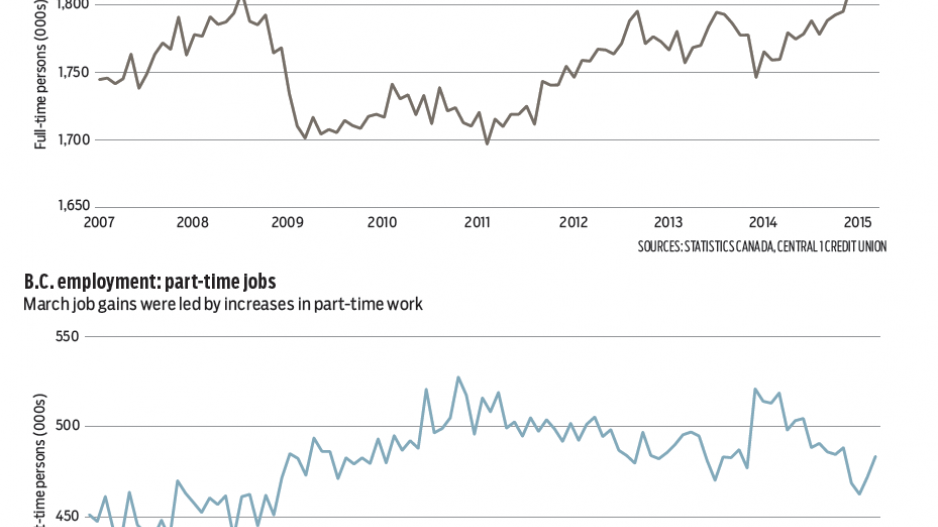

March B.C. employment gains were led by an increase in part-time work, which rose 2.4%. In contrast, full-time employment fell 0.3% from February to mark a second consecutive monthly decline. Full-time employment is the lowest since November. Nevertheless, full-time hires are up from a year ago by a healthy 2.6%, which has more than offset a drop in part-timers. This suggests employers have increased hours for part-time workers and increased head count, though at a subdued pace.

The goods-producing sector posted solid gains in March. While resource employment was unchanged from February and down a whopping 7% from a year ago, manufacturing employment jumped 1.2%, marking a gain of nearly 10% from last year. Increased agriculture (5.6%) and construction (0.7%) employment also added to monthly growth. B.C. residents working in the oilsands are being pinched by sector cuts, filtering into B.C.’s resource employment counts.

Employment growth on the services side of the economy was mixed. Robust monthly gains in transportation/warehousing (3.7%), finance/insurance/real estate/leasing (2%) and information/culture (2.6%) were offset by declines in public administration (-2.2%) and health care/social assistance (-2.1%).

Year-over-year, transportation/warehousing (7.6%) and information/culture (8.1%) have posted strong gains. However, declines have been recorded in trade (-3.4%), accommodations/food services (-4.6%) and public administration (-3.6%). Weaker trade employment could reflect some of the impact of retail closures that are underway or near conclusion, including those of Target and Mexx. Job losses stemming from the consolidation of Best Buy and Future Shop will be captured in May’s LFS report. Despite a mildly positive employment trend, B.C.’s labour market environment remains soft.

Average B.C. employment is forecast to rise 1.3% this year. Export-led economic growth, housing uplift and steady consumer spending will contribute to the gain. The unemployment rate is forecast to average 5.9%.

Bryan Yu is senior economist at Central 1 Credit Union.