Payroll counts and weekly earnings estimates for March remained aligned with our outlook for another year of solid growth for B.C.’s economy. Paid employment counts in B.C. jumped 0.3% in March after holding steady for two consecutive months, maintaining year-over-year growth at a healthy pace of 2.7% to outpace a national gain of 0.7%.

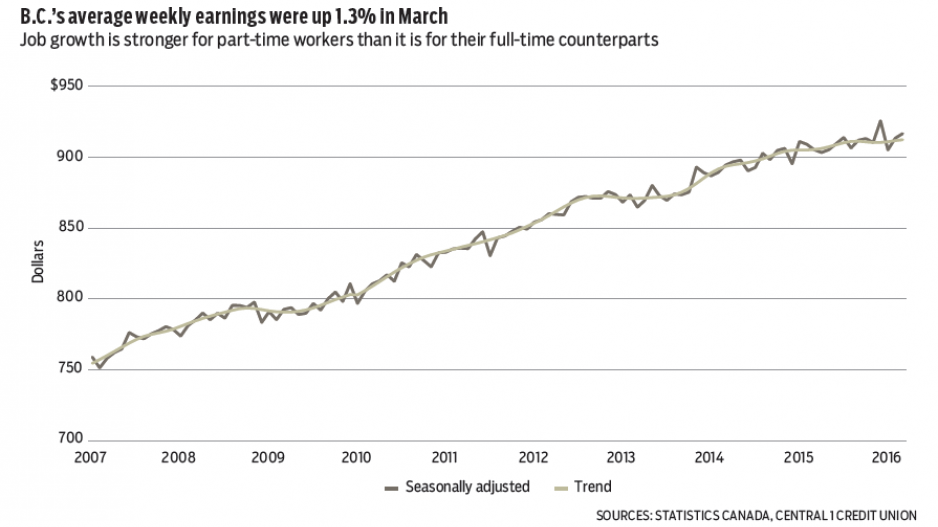

Average weekly earnings held range-bound at $916.50, a slight increase from February and a second consecutive gain, but broadly aligned with the levels seen since mid-2015. Year over year, B.C.’s average weekly earnings were up a mild 1.3% in March. While inconsistent with strong hiring momentum, weekly earnings partly reflect the types of jobs created. First-quarter job growth has been concentrated in the service sector (2.9%, year over year) with average weekly earnings of $871, compared with about 1% goods-sector employment growth with average weekly earnings of $1,155. Additionally, stronger growth in part-time relative to full-time employment this year is a factor, and population growth has maintained some labour market slack.

On the service-sector front, a number of sectors are showing employment gains and steady wages. Health services posted a 3% year-to-date gain in employment and year-over-year weekly earnings, while professional/technical services employment climbed 7.2% with relatively mild wage growth. High employment growth in some lower-earnings sectors including arts/entertainment/recreation and accommodations and food services weighed on overall average weekly earnings.

Weakness in the goods-producing sector is largely tied to the high-paying mining and oil and gas sector, as employment declined nearly 11% in the first quarter from a year ago, and year-over-year average weekly earnings fell 4.5% in March – but it was still the highest-paying sector at $1,894.

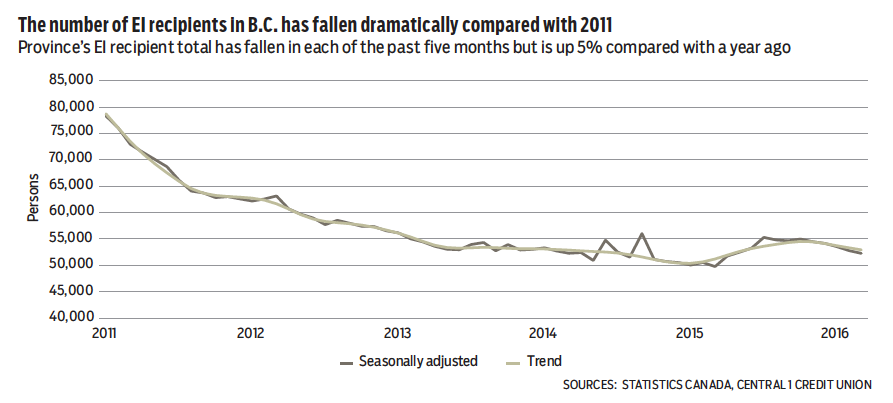

Total employment insurance (EI) counts declined 1% from February to 52,260 persons in March. While up a modest 5% from a year ago, this was a fifth consecutive monthly drop.

Declining EI counts could reflect benefit expiration, but more likely reflect B.C.’s economic growth, which led the country in 2015 at 3%. Some of the increase compared with a year ago may reflect an inflow of unemployed people from other provinces.

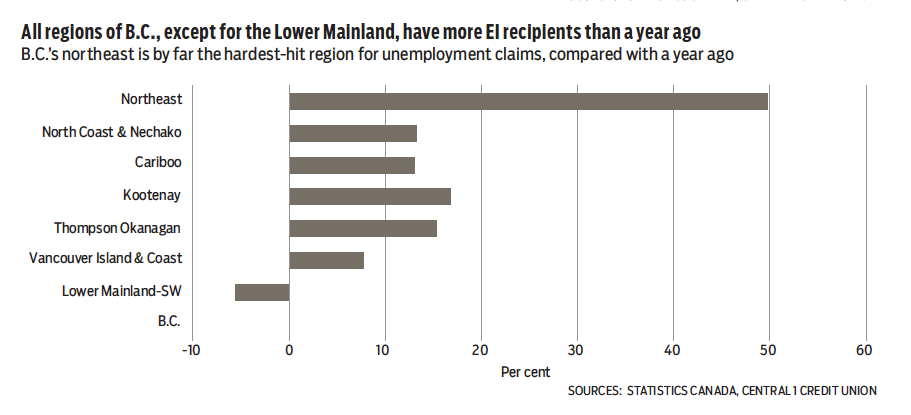

That said, improving provincial EI trends mask weak economic conditions in many commodity-oriented regions. On a 12-month trend basis, EI counts are up in all areas of the province relative to a year ago, with the exception of the Lower Mainland-Southwest (-5.6%), reflecting a strong regional economy. •

Bryan Yu is senior economist at Central 1 Credit Union.