April non-farm payroll data pointed again to modest growth in B.C. hiring, painting a rosier picture than data from the more often referenced Labour Force Survey (LFS).

According to the Survey of Employment, Payroll and Hours (SEPH), non-farm payrolls climbed 0.2% from March and a modest 2.2% from the same month in 2014 to 2.05 million persons in April. It continues the trend of 2% year-over-year growth observed since January and contrasts with the household LFS estimates of employment, which are flat from a year ago. SEPH and LFS estimates typically move in tandem over longer periods, but a clear divergence has occurred over the past two years with the SEPH payroll survey strongly outpacing LFS estimates.

Part of the differential reflects the fact that the SEPH excludes farm and self-employed workers. The SEPH estimate provides a better indicator of underlying hiring momentum given its reliance on Canada Revenue Agency administrative data rather than household reporting. Additionally, it should be noted that the primary purpose of the LFS is to estimate metrics like the unemployment and participation rates by dividing the population into employed, unemployed and not in the labour force, rather than gauging employment levels directly. SEPH is also more aligned with the strength in the broader economy.

Among sectors, year-over-year employment growth has been strongest in construction (5.0%), forestry and logging (5.6%), information/culture (4.3%), real estate and leasing (5.0%) and accommodation and food services (3.8%). Sectors that weighed on growth included mining, quarrying, and oil and gas (-16.5%), utilities (-7.1%), public administration (-0.3%), and finance and insurance (-0.8%).

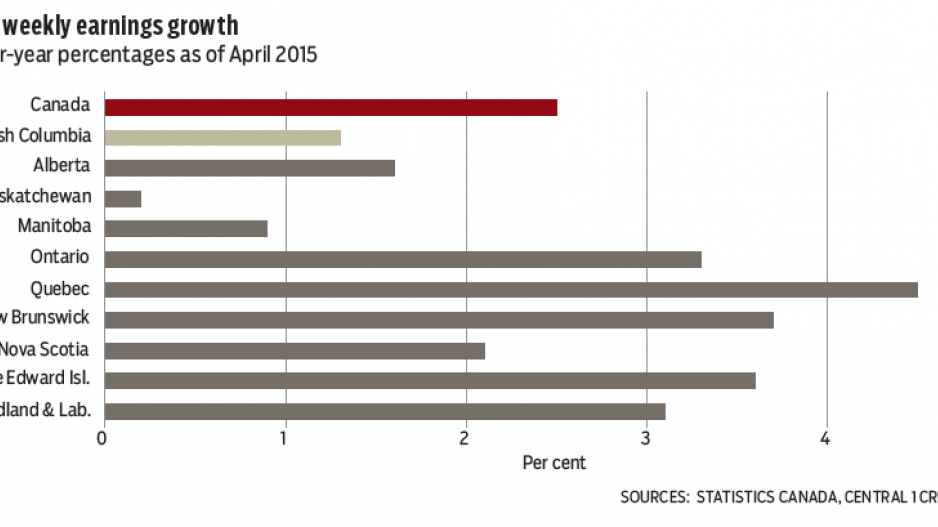

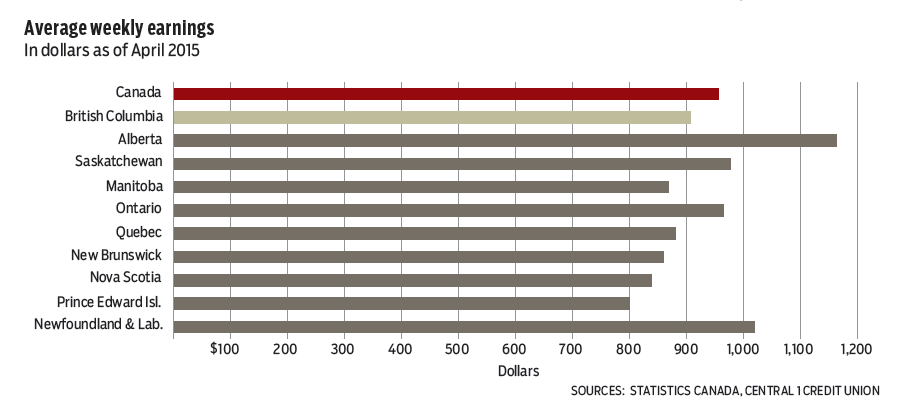

Despite posting the strongest year-over-year gain in non-farm employment among all provinces in April, wage-earning growth in B.C. remained relatively weak.

While labour market slack plays a role with unemployment still hovering near 6%, industry growth composition is also a factor. Job losses have been observed in relatively higher-paying sectors like mining, oil and gas and utilities and public administration. That is offset by growth in some lower-paid service sectors such as accommodations, food services and real estate services. However, even accounting for this compositional effect, wage growth in B.C. is still weaker than in the rest of the country. •

Bryan Yu is an economist at Central 1 Credit Union.