Last week's release of payroll employment data pointed to some brightening in B.C.’s labour market in January. According to the Survey of Employment, Payrolls and Hours (SEPH), employment was up 0.7% from December and 2.3% from a year ago to 2.04 million persons. Meanwhile, on average, B.C. workers recorded a solid pickup in income. Average weekly earnings climbed 2.2% from December to $914.60, and 3% above a year ago.

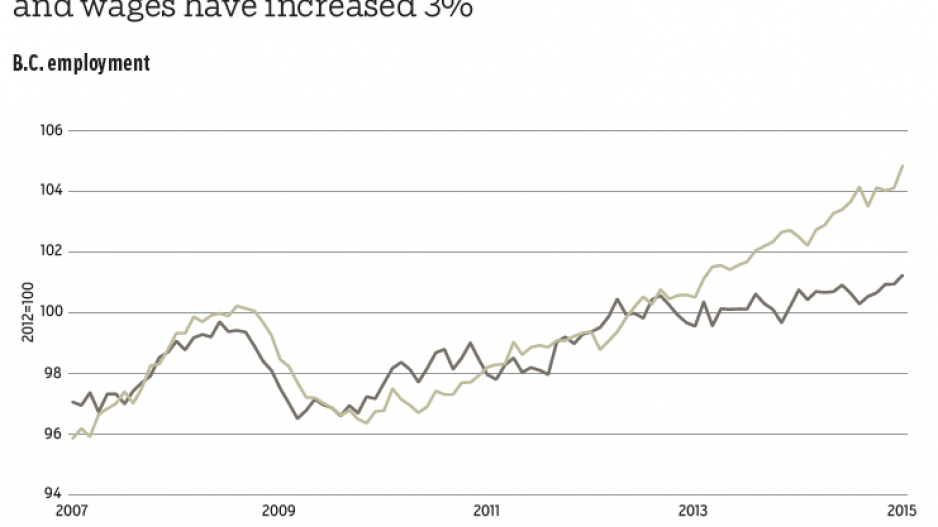

SEPH employment should not be confused with the more often referenced Labour Force Survey (LFS). The SEPH is a survey of businesses and uses Canada Revenue Agency administrative data; the LFS surveys households and includes the self-employed and agriculture workers. While employment trends in the surveys move together over longer periods and LFS employment readings in January were also higher, the measures have moved apart since late 2012. LFS employment is up only marginally over the period, while the employer measure is up closer to 4%.

We see SEPH or payroll measures as a better measure of hiring activity, but estimates are less timely than LFS. Hiring momentum is not as weak as the LFS suggests, but low self-employed counts and low participation rates still point to slack in the economy.

Weekly earnings estimates were surprisingly strong during the month after a two-month lull. With a gain of 2.2% from December, seasonally adjusted weekly earnings growth was strongest in B.C. among all provinces during the month. However, year-over-year growth of 3.1% was in line with the national performance and below gains of more than 4% in the Prairie provinces.

January’s uplift was driven by an increase in hours worked and sector-specific strength. Relative to December, weekly earnings were up in forestry (3%), utilities (15%), finance and insurance (7.4%) and management of companies (10.3%).

While January’s gain was modest and signalled some labour market improvement, B.C.’s average weekly earnings ($915) remained below the national average ($948). This trailed Alberta, Saskatchewan, Ontario and Newfoundland and Labrador, which in part reflects differences in industry composition. That said, a relatively brighter economic outlook in B.C., underpinned by exports, household spending, recent oil price volatility and the weakness in the economies of oil-producing provinces, will likely temper wage gains in other provinces to help narrow the gap. •

Bryan Yu is senior economist at Central 1 Credit Union.