Personal income tax in Canada turns 100 this year, having been introduced in 1917 as a means of funding the country’s efforts in the first world war, and the government’s dependence on it has grown to the point where it funds more than half of federal revenues, according to a Fraser Institute report released April 6.

When the tax was first implemented, it provided federal coffers with about 2.6% of its total revenue. This has grown to 51%, which makes this difficult-to-administer tax a drag on Canada’s international competitiveness as it affects the country’s ability to attract investment and people, according to the think tank’s report, The History and development of Canada’s Personal Income Tax: Zero to 50 in 100 Years.

“The fears policymakers had in 1917 when the personal income tax was introduced – that governments would become dependent on it and that it would hurt our competitiveness – have all come true 100 years later,” said McGill University associate economics professor William Watson, who co-edited the report.

“Just filing their taxes costs the average Canadian family $500 in time and money, even before they get to what they owe.”

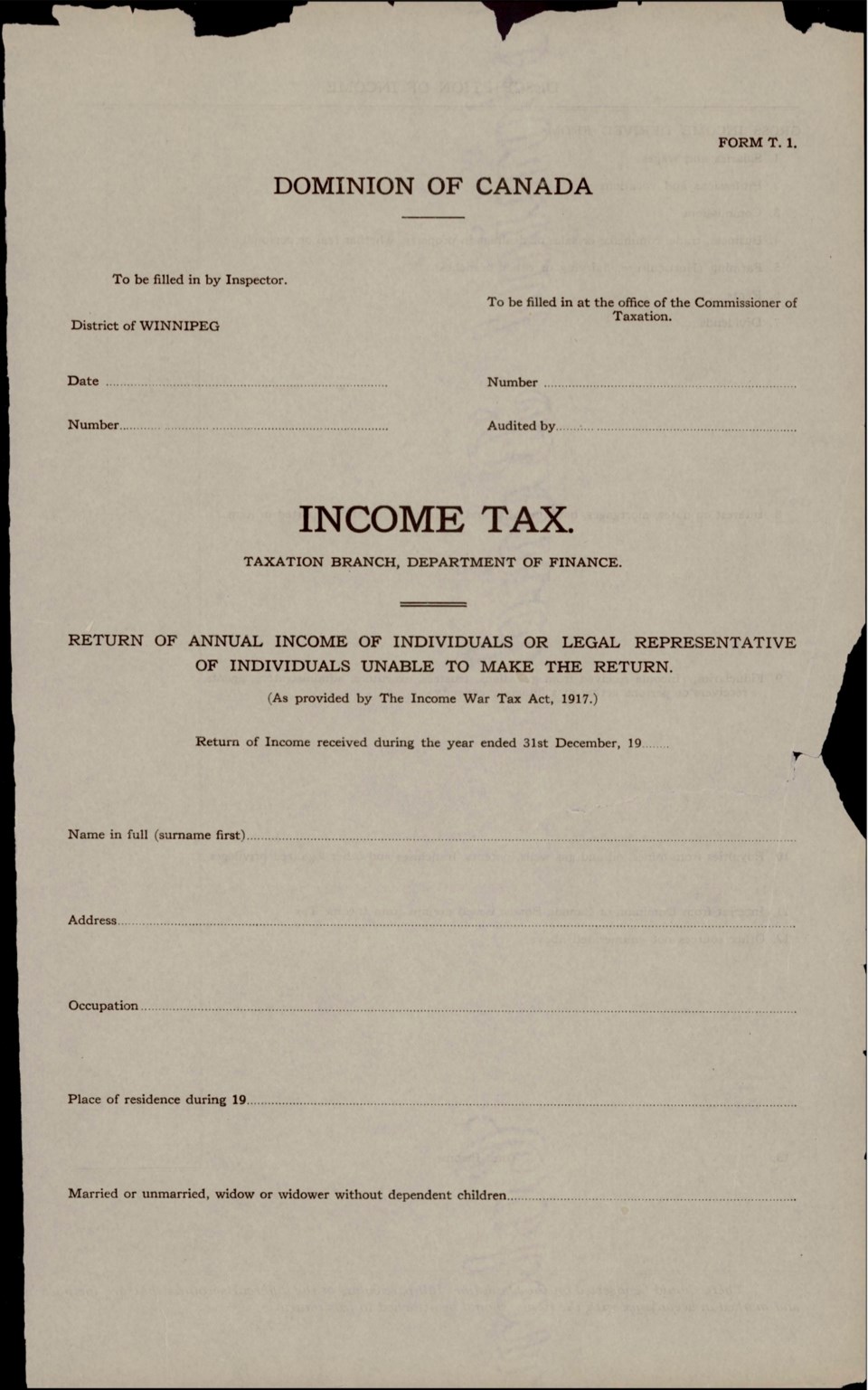

According to the report, the tax base has expanded significantly over the past century. In 1917, 2% of Canadians were required to pay income tax, with an average payment of $14 per person. This has grown to 75% of all Canadians who have to pay, with an average of $4,120 per person.. The complexity of the tax code has jumped as well, with the number of pages growing from 6 in 1917 to 1,412 100 years later.

Filing a report is more complicated, with the number of lines on the federal income tax return increasing from 23 to 328.

Dominion of Canada's first personal income tax form | To view complete form visit image source: Fraser Institute

The Fraser Institute found that when compared with the U.S., British Columbia is the most competitive province – but it’s not competitive enough, the report argues. The province has the lowest combined federal-provincial top personal income tax rate in Canada, but it is still higher than the combined federal-state top rates in 42 U.S. states.

@EmmaHampelBIV