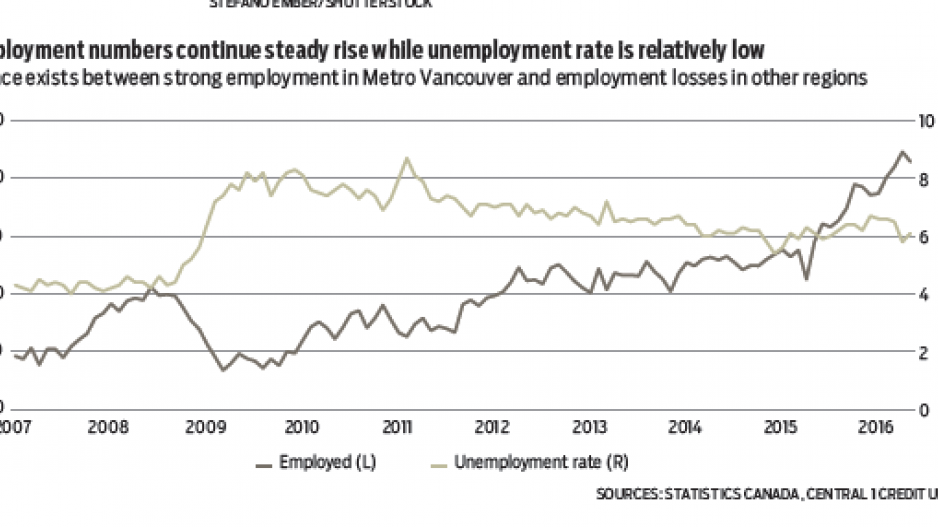

B.C.’s economy gave up much of April’s hiring surge in May, but provincial employment remained on a robust uptrend with widespread gains among sectors. Estimated employment declined 0.4% (8,400 persons) from April but continued to sizzle on a year-over-year basis at 3%, compared with a 0.6% national gain. Unemployment rose modestly from 5.8% in April to 6.1% of the labour force in May.

Year to date, employment growth held steady at a 3.5% pace and remained well above the national gain of 0.8%, with robust growth in both full-time employment (2.7%) and part-time work (6.3%).

However, there was a clear divergence in employment between Metro Vancouver and the rest of the province. In contrast to a provincial decline, Metro Vancouver employment was up 0.4% from April and 5.7% year over year, compared with a contraction in the rest of B.C.

On an industry basis, substantial fluctuations in May could reflect the impact of Alberta wildfires on B.C.’s commuter workforce that work in the oilsands. Month-to-month declines were recorded in manufacturing (-5.3%), utilities (-6.3%) and wholesale/retail trade (-2.6%), offset in part by gains in resource extraction (5.2%), public administration (5.6%), finance, insurance and real estate (1.9%) and other services (3.8%) sectors.

Year-to-date employment gains were similar among both goods and services industries but were led by resource extraction (16.5%), public administration (14%) and trade (6.1%).

On the housing front, B.C. housing starts fell sharply in May to an annualized pace of 35,300 units, down from 45,600 in April. However, this does not signal a weakening market because starts came off an unsustainable high of more than 40,000 units during the first four months and remained above the range observed through 2015. Robust demand for resale homes and low inventories are driving new home construction and renovation spending.

Year to date, urban B.C. housing starts climbed 45% to 16,320 units. The 50% increase in Metro Vancouver represented about 80% of overall growth, and growth more than doubled in Abbotsford-Mission and Kelowna. Starts climbed in most urban areas, with the exception of Nanaimo and Courtenay.

We forecast full-year housing starts (including rural areas) to rise 21% this year to 38,200 units and push above 40,000 units in 2017.•

Bryan Yu is senior economist at Central 1 Credit Union.