Ottawa last month changed a law to allow brewers and distillers to ship their products directly across provincial boundaries.

Provinces, however, are as resolute in their attempts to prevent those shipments as they are with attempts to stop interprovincial wine shipments, which became legal federally two years ago.

Only B.C. and Manitoba allow residents to order wine direct from out-of-province wineries. All other provinces require the wine to flow through provincial liquor boards, where markups are applied that are not applied to that province’s own wineries.

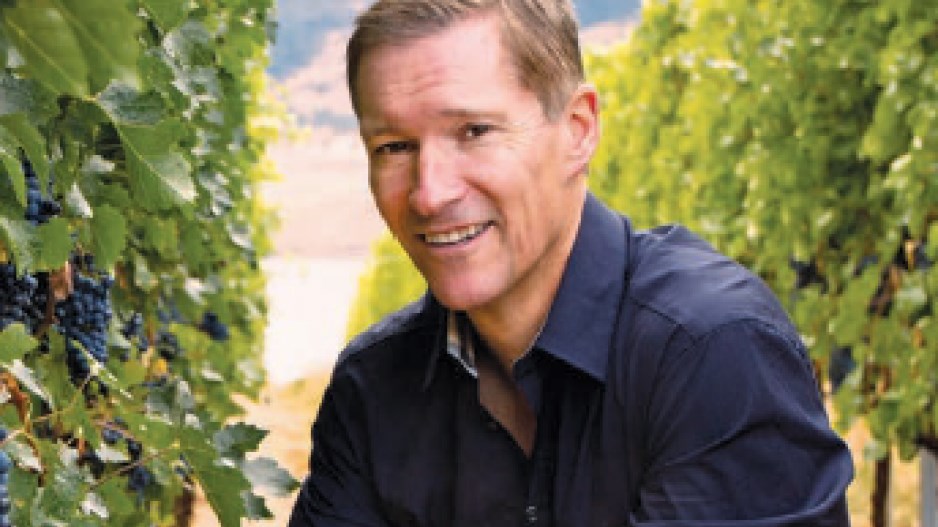

And while some winemakers, such as Painted Rock Estate Winery owner John Skinner, defy provincial regulations by sending cases of wine directly to out-of-province customers, provinces are starting to get litigious to try to stamp out that practice.

Newfoundland, for example, charged FedEx in May with illegally delivering what it considered to be contraband wine. The province has since told courier companies to deliver all wine shipments to its liquor board.

Winemakers are discussing court action, which lawyers say has a good chance of succeeding.

“The Constitution says that there should be a free trade zone within Canada for all Canadian-produced products,” Vintage Law Group principal Mark Hicken told Business in Vancouver.

“Cases that have interpreted that section of the Constitution have said that provinces can apply taxes and fees to Canadian products that come into the province from other provinces, but they can only do that on the basis that those same taxes and fees be universally applied.”

He added that a separate Constitutional argument is that Ottawa has exclusive jurisdiction over interprovincial and international trade. Ontario Ministry of Finance spokesman Scott Blodgett disagreed.

“The legal framework and our trade agreements recognize that each province and territory controls the shipment of wine into its market,” he told BIV. “This is important for both social responsibility and revenue reasons.”

U.S. states made similar arguments, saying cross-border direct shipments would cut into revenue, before the U.S. Supreme Court forced them to allow such shipments, Hicken said.

He added that states now require wineries to register with state liquor authorities and pay standard taxes on the shipments.

“Liquor revenue has not gone down in B.C. or Manitoba since they opened up their borders to direct wine shipments from other provinces,” Hicken said. “The amount of wine that is involved is also so small that the revenue we’re talking about is insignificant.”

While B.C. has been quick to allow residents to order out-of-province wine directly, it might take its time before allowing similar shipments of beer and spirits.

B.C.’s Justice Ministry said in a statement that it’s waiting to “get a better sense of what other provinces will be doing” before it opens its borders to out-of-province beer and spirits.

Winery owners have told BIV that they favour direct-to-customer wine shipments because they’re more profitable than sales to the BC Liquor Distribution Branch (BCLDB).

The BCLDB levies more taxes and fees on wine sold through its stores than it does on cases of B.C. wine sold directly to customers.

Meanwhile last week, the three western premiers called for the dismantling of interprovincial trade barriers.•