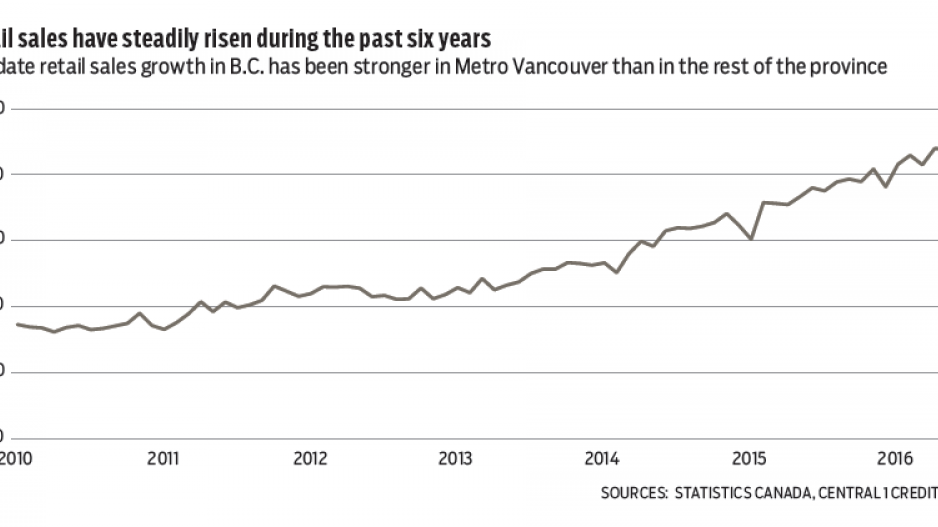

Retail sales growth in B.C. picked up again in July to outpace its provincial peers and regain traction following a two-month lull. Total dollar-volume retail sales climbed 0.9% from June to a seasonally adjusted $6.25 billion, compared with a national sales decline of 0.1%.

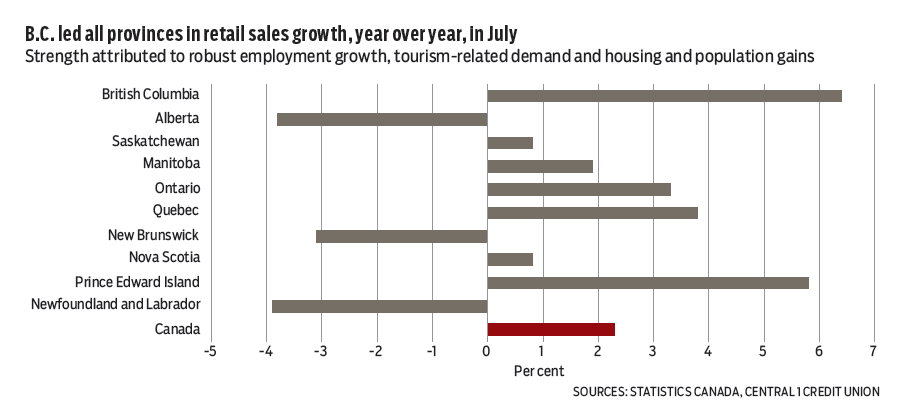

Year-over-year sales growth accelerated from June to remain head and shoulders above the rest of the country at 6.4% in July, compared to 2.3% nationally. Nearly all retail segments posted gains, with the strongest in building materials and gardening equipment (16%), clothing, and home furnishings (6.8%), and motor vehicles.

Retail spending strength in B.C. reflects robust employment growth, tourism-related demand, housing and population gains, but concentrated in the Metro Vancouver area. Year-to-date provincial sales growth of 6.5% was led by a near 8% gain in Metro Vancouver, with a 5% rise elsewhere in the province. Mild national retail price inflation of less than 1.5% suggests real growth of about 5%.

Retail spending is forecast to remain solid with annual growth of 6% to 6.5%, but there are risks related to downside momentum in Metro Vancouver housing activity. Sales have declined since a spring peak and curtailed sharply since the introduction of a foreign buyer tax in August. While we deem the effect to be transitory, this will weigh on housing-related sales.

As noted, tourism is one of the brightest lights in the current B.C. growth cycle as a low Canadian dollar and rising global demand for overseas travel contribute. Total international tourist visits to B.C. reached a seasonally adjusted 450,000 visitors in July. This marked a 0.7% gain from June. U.S. entries climbed 0.8%, following three months of decline, while overseas visits increased for a second straight month with a 0.4% gain.

While visits fell from an early-year high, which was aided by a lower Canadian dollar and special events including the Canada Sevens rugby tournament in Vancouver, July’s inflow was well ahead of a year ago by 10%. Record-high overseas visits and a rebound in U.S. tourism flows to mid-2000 levels have lifted inflows to a near-record pace. Year-to-date, inflows have climbed 12.5%.

Provided the Canadian dollar remains range-bound, tourism flows should remain elevated over the next two years, owing to a strengthening U.S. economy and rising demand for overseas travel from emerging markets, including China and Mexico. •

Bryan Yu is senior economist at Central 1 Credit Union