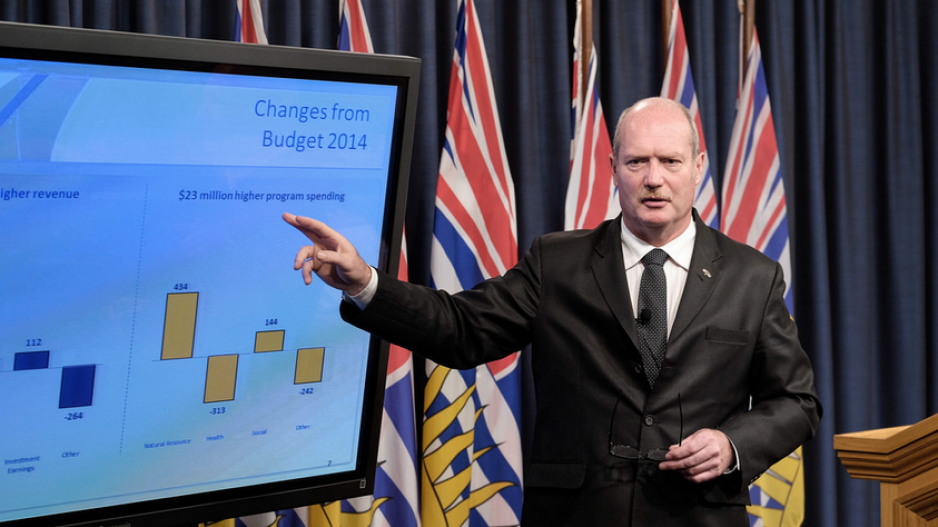

Finance Minister Mike de Jong, appearing before reporters in Victoria, revealed that not only had overall government revenues increased by almost $1.48 billion, but so did spending, by $2.44 billion.

“Revenues to government are up, there are more people coming to B.C. from other parts of the country, from other parts of the world, that is putting pressure on the services that British Columbians expect in a variety of ways, education, healthcare, the government wants to respond to that,” de Jong said. “What you see is a response from the government to some of those pressures, some of those case load pressures.”

The property transfer tax brought in $630 million more than the government had budgeted.

“I tend to think of taxes as taking money out of the economy and therefore generally not contributing to growth and GDP,” de Jong said. “In this instance though one could make the argument that the increased tax revenue is a reflection of market activity.”

For months, the BC Liberals had resisted pressure from the NDP to intervene in Metro Vancouver’s bustling housing market, but finally caved at the end of June. The Legislature returns for a four-day sitting next week, to amend the Vancouver Charter for a tax on vacant houses and apartments and to end self-regulation of the real estate industry.

The vacant properties tax won’t be expanded to other municipalities for now, de Jong said.

“I’m not hostile to the notion at all of providing a similar option to other municipalities, that involves an amendment to the community charter, probably interested to hear what those other committees have to say at UBCM,” he said.

De Jong was asked whether the government may also bring in a tax on foreign buyers. He paused and said “my definition of that might be different from yours” and declined to say more on the topic. Preliminary self-reported data on housing sales for 19 days in June indicated that residential purchases by Chinese citizens outpaced those by American citizens by an 11 to 1 ratio.

De Jong said that, despite a new civic tax that could be replicated elsewhere, increasing supply of housing should be the priority.

Meanwhile, the province’s total debt grew $2.37 billion, something that concerns the Canadian Taxpayers’ Federation. B.C. director Jordan Bateman said that if they added the surplus and held the line on spending, that could have been kept to $1.7 billion. Bateman is concerned the government will use the surplus to “buy votes” with spending promises in advance of the May 9, 2017 provincial election.

“The temptation for government will be to spend the surplus on gimmicks to get re-elected,” Bateman said. “We would like to see it applied to the debt in order to save future taxpayers’ money.”

The total debt was $65.3 billion, up more than $20 billion since 2011 when Premier Christy Clark took power and almost $31 billion more than 2006. Taxpayer-supported debt to GDP was 17.4%, as had been forecast in the budget.

The latest debt figures include $42.73 billion in taxpayer-supported debt and $22.57 billion in self-supported debt. The former includes government operations ($8 billion), schools and universities ($12.76 billion) and transportation infrastructure ($11.47 billon). The latter includes almost $18 billion for BC Hydro and $3.4 billion for the Transportation Investment Corporation, which operates the Port Mann toll bridge.

The government also reported $101.4 billion in contractual obligations for operations, maintenance and infrastructure, of which $75.5 billion is booked for 2022 and beyond.

De Jong only took questions from reporters at the Legislature in Victoria. The two Vancouver-based reporters who attended the boardroom of the cabinet office at Canada Place were only allowed to listen to the news conference. BIV’s request to interview de Jong after the news conference was not fulfilled. His staff claimed that he had a meeting.

Full-time equivalent employment at Crown corporations and agencies increased slightly, from 4,798 positions to 4,803. A closer look showed more evidence of the decline in resources and the rise in real estate. B.C. Assessment Authority grew from 682 to 726, year-over-year, while the Oil and Gas Commission’s payroll decreased from 283 full-time equivalents to 250.