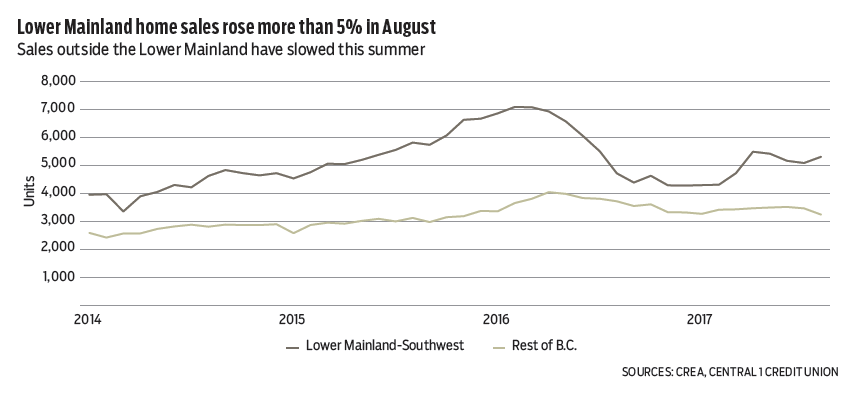

After an upward trend through mid-year, Multiple Listing Service sales have stuttered, and levels were unchanged from July at a moderate 8,536 units in August.

A 5% monthly gain in Lower Mainland sales was offset by significant declines on the Island and in Interior markets. Relative to same-month 2016, sales were up 2.4%, marking the first positive reading in a year, but reflected sharp sales declines last August following implementation of the Lower Mainland foreign-buyer’s tax. A year-to-date decline of 15% largely reflects abnormally strong sales in early 2016 and negative policy shocks in the second half of the year.

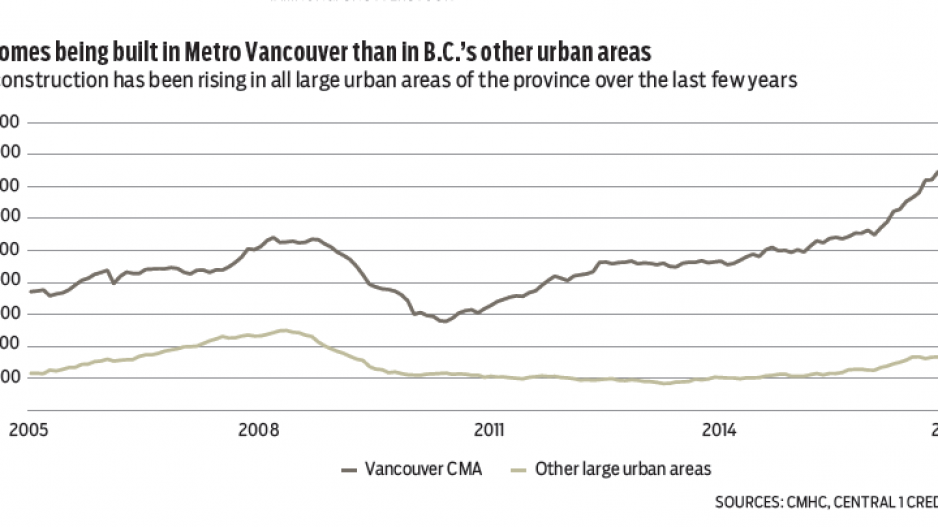

Despite signs of a peak, sales are strong. Most regions are tracking increases in line with prior cyclical peaks from the mid-2000s, reflecting low interest rates and expansion in the economy and population, offsetting credit constraints from tighter federal mortgage insurance rules and provincial policies. Record wildfires may also be a factor in sharper declines in some Interior and northern markets.

While off the recent fevered pitch, sales-to-inventory ratios continue to favour sellers and price growth. Constant-quality price measures pointed to strong growth in the Lower Mainland of 1% per month, with a 1.5% to 2% pace on the Island. Year-over-year growth in the latter was 16% in Victoria and 20% elsewhere on the Island.

It’s expected that higher mortgage rates and prospects of further tightening of mortgage underwriting standards in the fall will slow sales.

B.C. international merchandise exports plunged in July after a strong first-half pace. Led by forestry products, consumer goods, and energy and mining product declines, export growth slowed to -0.7% on a year-over-year basis in July, following a 26% increase June.

As export volume can fluctuate sharply, July’s decline is not an immediate concern. Year-to-date sales were still 20% higher than a year ago, owing in large part to higher commodity prices. Temporary factors have played a role, with record wildfires curtailing timber harvest and lumber production at Interior mills. This will rebound in future data, although U.S. protectionist policies will continue to weigh on the forestry sector.

Exports will be an important economic driver, reflecting growth in B.C.’s global trading partners such as the U.S. and China, and a favourable – though rising – Canadian dollar. Improving economic fortunes in Alberta and other provinces will buoy interprovincial exports. Real export growth is forecast at 4% this year and 3% in 2018. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.