B.C. payroll earnings and employment estimates bounced back in September following deceleration in August. Average weekly earnings growth in B.C. outpaced the national performance in September with a monthly increase of 1.3% to $914.59, marking a 1.9% gain from a year ago. In comparison, Canadian weekly earnings climbed 1% from August and 1.7% on a same-month basis. B.C. weekly earnings remained below the national average of $955 and were fifth-highest among the provinces. Industry composition is a key contributor to these differences, as workers in provinces geared more to energy and mining, despite current challenges, still average higher earnings. Among provinces, average weekly earnings in Alberta topped the country at $1,135, followed by Newfoundland and Labrador.

While estimates of earnings often fluctuate on a month-to-month basis as multiple factors, including industry-specific wages, employment composition (and growth) and average hours worked, feed into headline provincial figures, September’s uplift does point to modest improvements in the provincial labour market and income.

Weekly earnings growth is broadly trending around 1.7%, but this remains below 2014 trend growth. The fixed-weight earnings index, which adjusts for paid hours and employment mix, points to stronger year-over-year growth in the range of 2% to 2.5%.

In contrast to average weekly earnings, this is higher than 2014, pointing to stronger hourly wage gains and suggesting that industry-specific weakness has dampened average earnings gains this year.

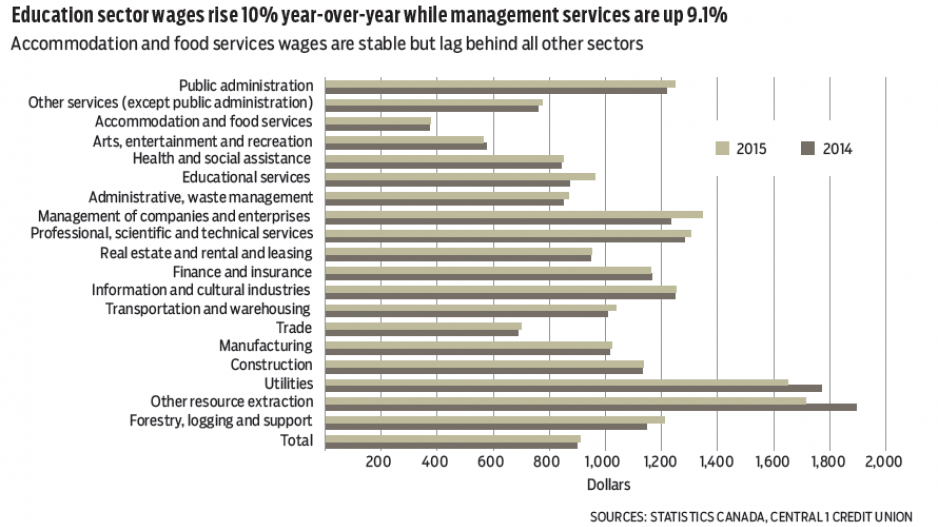

Not surprisingly, mining resource sectors have been a drag on labour income. Average weekly earnings in the third quarter were down 9% from a year ago as the weak commodity backdrop has cut work in this sector while weekly pay in the utilities sector fell 7%. Resources have faced weak wage growth and cuts in hours worked (not to mention jobs). A near 6% uplift in forestry provided some offset. In contrast, weekly earnings growth has climbed in education (10%), management services (9.1%) and other sectors. Fixed-weight indexes point to higher hourly wages driving these gains.

September’s uplift in earnings coincided with a rebound in non-farm payroll employment, which climbed 0.4% to 2.07 million persons, marking a 2.6% gain from a year ago. Average year-to-date payroll employment is up a solid 2.2% through three quarters, led by substantial gains in forestry (7.5%), construction (4.6%), professional/scientific/technical services (3.8%) and accommodation and food services (3.6%). Offsetting some of these gains was a 14% drop in mining and other resource extraction.•