The heat is rising for the southern B.C. and Vancouver Island real estate markets as solid demand and low inventories drive home prices higher.

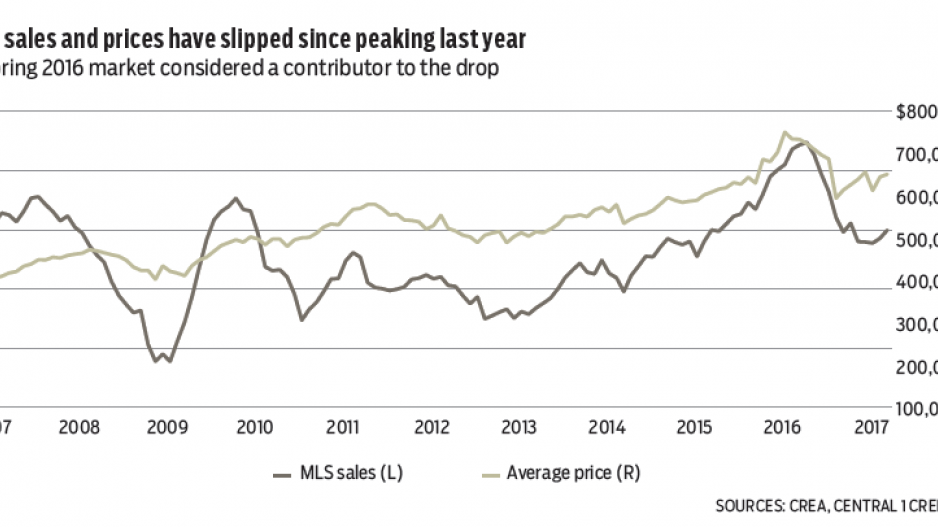

B.C. Multiple Listing Service home sales climbed for a second straight month in March to signal an upturn in sales. Seasonally adjusted sales rose 3.6% from February to 7,990 units. Year-over-year declines in sales narrowed from February to about 26.5%. As we often repeat, sharp year-ago declines primarily reflect a surge in sales last spring. Current provincial sales are similar to levels observed during the robust 2005-to-2007 period.

Real estate boards in the Lower Mainland-Southwest region led monthly gains, while sales also picked up in the Kamloops area and Vancouver Island outside Victoria.

Looking beyond monthly numbers, regional housing markets are solid. Sales in the Lower Mainland region are near the 10-year average and track previous cycle highs observed in the mid-2000s on Vancouver Island and in the Thompson-Okanagan. Kootenay-area sales are rising, but northern B.C. activity remains relatively subdued.

A key story is low resale housing supply. New listings in March fell 21% from a year ago and active listings declined 18%. Outside northern B.C. and the Kootenay, listings are near or below previous cycle lows in the mid-2000s and triggering stronger price gains.

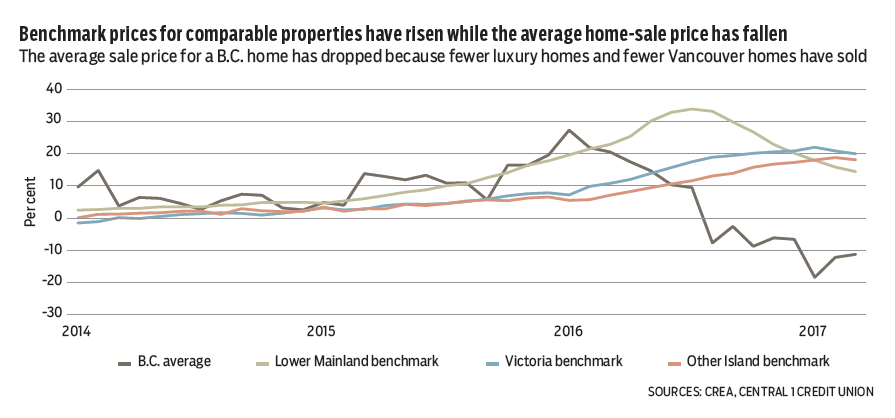

This strength is masked in the average provincial price, which climbed 1% from March to $651,480, but fell 11% from a year ago. The decline reflects a change in sales composition away from the Lower Mainland markets, and fewer luxury and detached-home sales, rather than price erosion. Vancouver Island and Okanagan average prices are tracking up about 10% from a year ago.

Benchmark prices are better measures of price trend but are available only in select markets. Lower Mainland benchmark prices are edging up after a recent slip, and were up 14% year-over-year. A 10% average price drop is due to a sharp decline in detached-sales share. Vancouver Island real estate board benchmark values were 20% above a year ago.

Meanwhile, new vehicle sales in February signal robust consumer demand. While data is choppy with monthly sales falling back after a January increase, sales through the first two months were 1.7% higher than a year ago. Momentum has picked up following a mid-year lull, pushing the trend well ahead of previous cycle peaks observed prior to the recession. Low interest rates and longer financing periods allowed consumers to buy more expensive vehicles. Average values were up 6% to 8% from last year. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.