It’s a well-worn ploy for new incoming governments to blame the previous one for leaving a mess, but in the case of ICBC, the B.C. NDP government is armed with a new 195-page report that suggests that that is, in fact, the case.

The “alarming” report by EY – commissioned by the Liberal government and ICBC board of directors – confirms that ICBC is facing a financial crisis and may be in need of some radical structural changes.

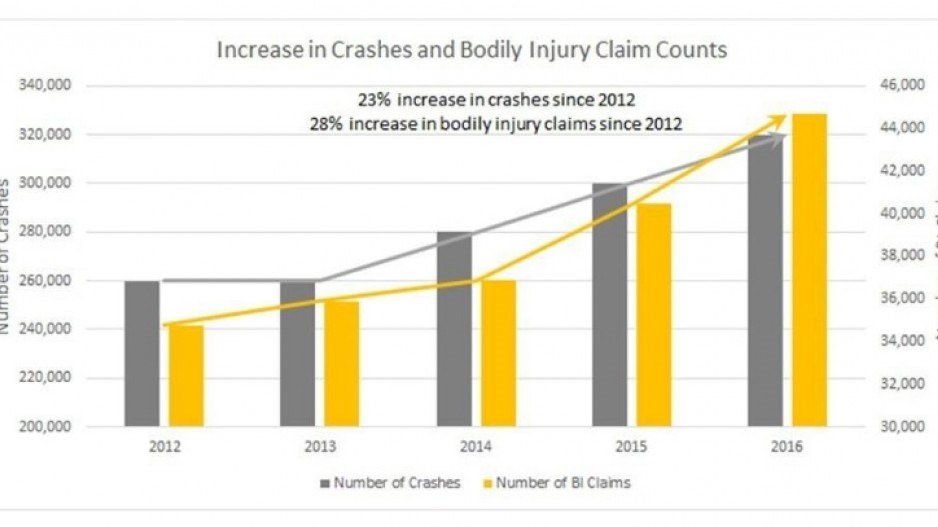

Accidents and claims costs have skyrocketed in recent years, and premium hikes have not kept pace with the increased costs, thanks to rate hike caps implemented by the Liberal government.

“This rate of protection (from premium hikes) has eroded ICBC’s financial situation to a point where it is not sustainable,” the report concludes.

Drivers in B.C. now face a 30% premium hike by 2019, if structural problems aren’t fixed, the report warns.

But two key recommend fixes – bringing back photo radar and moving to no-fault insurance – were dismissed out of hand by B.C.’s new attorney general, David Eby, at a press conference this afternoon, July 24.

“There are a couple of obvious proposals in the report that are non-starters from our perspective,” Eby said. “One is photo radar, the other is no-fault insurance.”

The EY report found there is a $560 million gap between revenue raised through premiums and claims costs – a gap that will grow to $1.1 billion annually by 2019.

“It appears that there are two main drivers of the problems we see here,” Eby said. “One is that the Liberals have been using ICBC as a bank machine, bringing money out of the corporation to claim better finances than are currently the case.”

He referred to the hundreds of millions that ICBC and BC Hydro were forced to pay into general government coffers in annual dividends under the Liberal government.

“The second is that, as the crisis grew, in relation growing accident reports and safety issues on our roads, they failed to take the actions necessary to bend the curve toward higher costs for this corporation,” Eby said.

But given that the NDP has promised to limit ICBC premium increases, and has already rejected a key recommendation – moving to no-fault insurance – it’s unclear how the NDP will be able to fix ICBC’s structural problems. Eby suggested there could be technology fixes, as well as premium hikes for bad drivers.

“One of the obvious opportunities that’s out there that’s identified in the report that’s very straight forward for us is that good drivers should be rewarded for good driving, and people who are bad drivers should have to pay higher rates,” Eby said. “It seems like a no-brainer for us.”

In fact, it’s such a no-brainer that it’s a model ICBC has used for years. B.C. drivers with clean driving records already do pay lower premiums, while drivers pay higher premiums each time they have an accident for which they are at fault.

Andrew Wilkinson, whose appointment as attorney general in the last days of the Liberal government was short-lived, crashed Eby’s press conference and later told reporters that the NDP seems to have no plan.

“What we’ve seen today is that the NDP government has ignored the fact that we already have safe driver discounts, have ignored the fact that we already have increased premiums for hazardous drivers, they’ve ignored the fact that ICBC has not taken a premium in recent years,” Wilkinson said.

“And so we now have a government that’s telling us what they’re not going to do and has completely failed to tell us what they are going to do on a subject that affects millions of motorists in British Columbia.”

When challenged to state what the Liberals would do, Wilkinson suggested that’s no longer their job.

“They’re now in government and now the hard work of government begins where they have to make tough decisions,” he said.

Although the paying of dividends to the government by Crown corporations has been a contentious issue, it’s not highlighted in the EY report as one of the main problems.

The problem is simply that B.C. has seen a dramatic increase in accidents and skyrocketing claims. The cost of repairing vehicles has also soared, as cars become more high-tech. And as the report points out, B.C. has a disproportionately high number of “high-value” vehicles (i.e. $150,000 or more) that are more costly to repair.

The report also notes that the rate of claims is “significantly outpacing the rate of crashes.” The cost of minor injury claims has increased 30% since 2020.

B.C. has a litigation-based insurance system. The report suggests B.C. could lower claims costs by placing caps on awards for pain and suffering in minor injury claims.