January's hopeful upshift in employment now looks like a head fake as B.C.’s labour market retraced the hiring growth in February.

Total B.C. employment was estimated at 2.28 million people in February, down 7,000 or 0.3% from January. This brought employment back to the levels seen in late 2014 and points to a period of mild hiring in recent months. Year-over-year growth was 0.5%, while the unemployment rate climbed to 6%, up from 5.6% in January.

February’s performance was another reminder to avoid getting too excited about any given month of data. Full-time employment fell by 16,500 people (0.9%), which more than erased the previous month’s gain, while part-time employment provided a partial offset with a gain of 9,600 (2.1%).

Among industries, lower employment was concentrated in the economy’s goods-producing sectors. In particular, resource employment fell off a cliff, shedding 7,200 workers, or 13.2%. Part of this was a reversal of January gains, but could be influenced by challenges in Alberta, which also shed jobs in the sector. Labour force estimates are based on place of residence, so job losses by B.C. residents working in Alberta would be counted in B.C.’s employment statistics.

Excluding resources and utilities, employment was generally steady in most industries. Service-industry employment was broadly unchanged from January. Education services climbed 3.3% and business services gained 2.4%. This offset some weakness in transportation and warehousing (2%) and accommodation and food services (1.9%).

February’s weak labour report takes some wind out ofB.C.’s economic sails, but it isn’t entirely bad news. Despite an overall year-over-year gain of only 0.5%, full-time employment continued to outperform by a wide margin and was up 3% compared with a decline in part-time activity. This positive shift has lifted total hours worked by 4.5% (year-over-year), which is a better indication of real employment activity.

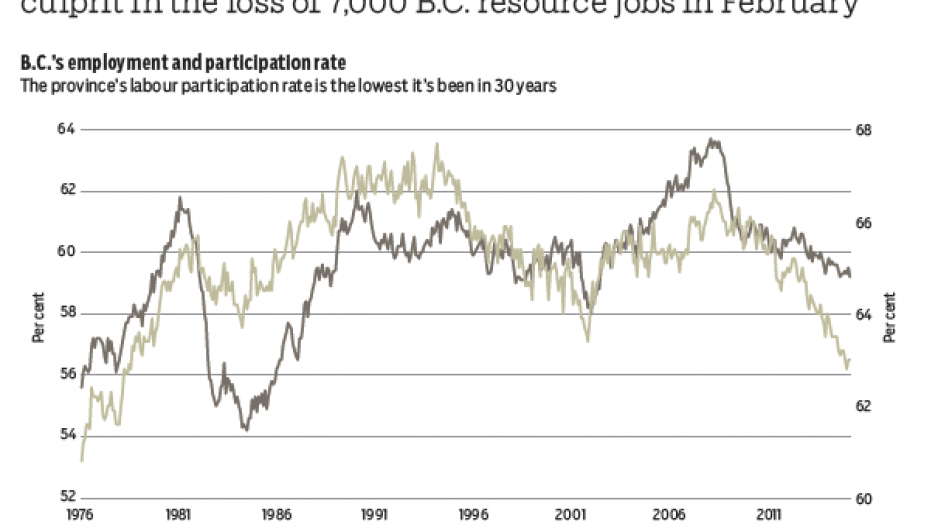

That said, the labour market is still soft, with participation rates at 30-year lows, and employment as a percentage of the population the lowest since 2001.

Hiring is anticipated to pick up this year. Stronger export-led economic growth, housing uplift and steady consumer spending will drive employment growth of 1.4%. The unemployment rate is forecast to average 5.8%.•

Bryan Yu is senior economist at Central 1 Credit Union.