Exporters boasted a strong gain in sales in July, signalling improvement in their fortunes after lacklustre activity in the second quarter. Dollar-volume goods exports jumped 5.5% from June to a seasonally adjusted $3.2 billion. Unadjusted, sales climbed 4.6% from a year ago, largely reflecting a rise in physical shipments rather than prices.

Key contributors to the year-over-year gain in July included processed mineral and metal products, forestry products, a pickup in industrial machinery and parts and less drag on the energy front.

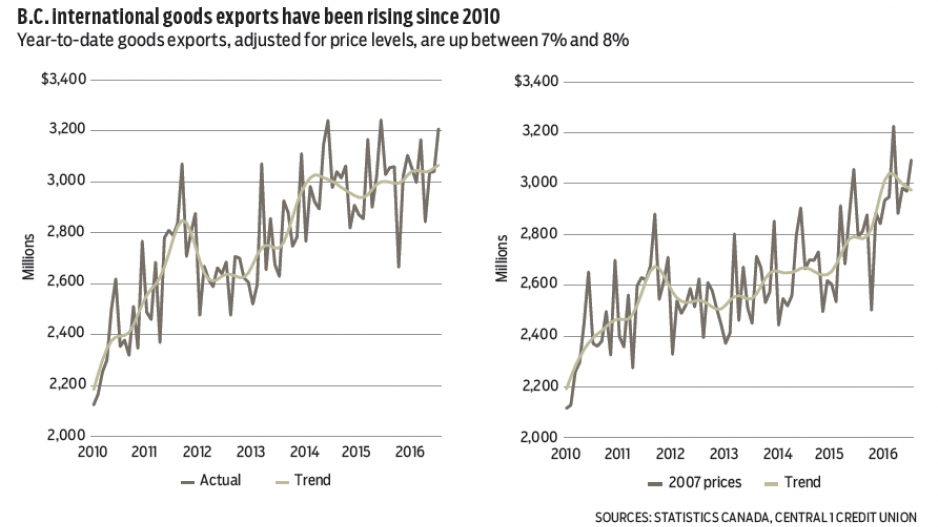

Current-dollar exports moved back to the upper end of the range observed since mid-2015. While the trend is subdued with year-to-date growth of only 1.2%, real shipment growth is stronger. Year-to-date goods exports, adjusted for price levels, are up by 7% to 8%.

The difference between dollar-volume and shipment growth is highlighted by energy products, which fell 15% year-to-date in dollar volume terms. While coal and natural gas dollar-volume international exports were both down 21%, physical exports of natural gas were flat from last year and coal fell about 7%.

Higher exports and lower imports point to a positive contribution from international trade to the economy this year, particularly when services exports such as tourism are added to the equation. A favourable exchange rate and broadly improving conditions in the U.S. are driving gains.

Non-residential investment received a boost in the first quarter with construction starting on two large northern B.C. projects. According to the Major Projects Inventory, the dollar value of new projects underway in the quarter reached $2 billion.

Commencement of the $811 million Brucejack Gold Project in Iskut and the $715 million Tower Gas Plant in Fort St. John drove the gain.

The Q1 lift boosted the capital value of major projects at various stages of construction to $77.4 billion, up 3% from the fourth quarter. Projects underway also include the Site C Dam ($8.3 billion), 10-year upgrades to Vancouver International Airport ($2.9 billion) and the final stages of the Evergreen Line ($1.4 billion).

The value of proposed projects in B.C. was $329.3 billion, reflecting high potential investment. However, uncertainty surrounds much of this stock given half reflects LNG-related activity, and another $21 billion is mining-related. Market conditions mean few if any of these projects will get underway in the near future. Many projects in inventory also lack proposed start dates. •

Bryan Yu is senior economist at Central 1 Credit Union