British Columbia’s spending growth has been blowing the rest of Canada out of the water this year. National growth was 1.8% with Ontario at a distant second with a 3.9% gain

After February's surge in retail activity, it is not surprising that sales growth took a breather in March, especially considering last week’s report of lower new vehicle sales during the month.

Total retail sales reached a seasonally adjusted $5.81 billion in March, which was down 1.7% from February’s record high.

Despite the drop, sales remain elevated and were still 8% higher than the same month in 2014 despite an 11% drop in gasoline sales.

Retail activity in the province is humming along despite the March setback.

Through one quarter, sales were up 7.8%.

Excluding gasoline sales and the motor vehicle and parts sub-sector, which is a better measure of core activity or underlying consumer demand, sales climbed 10%.

Growth has been driven by Metro Vancouver, which posted a year-to-date increase of 10%, compared to 5.5% elsewhere in the province.

Mild retail price growth and consumer price inflation point to real sales increases, rather than price-induced gains.

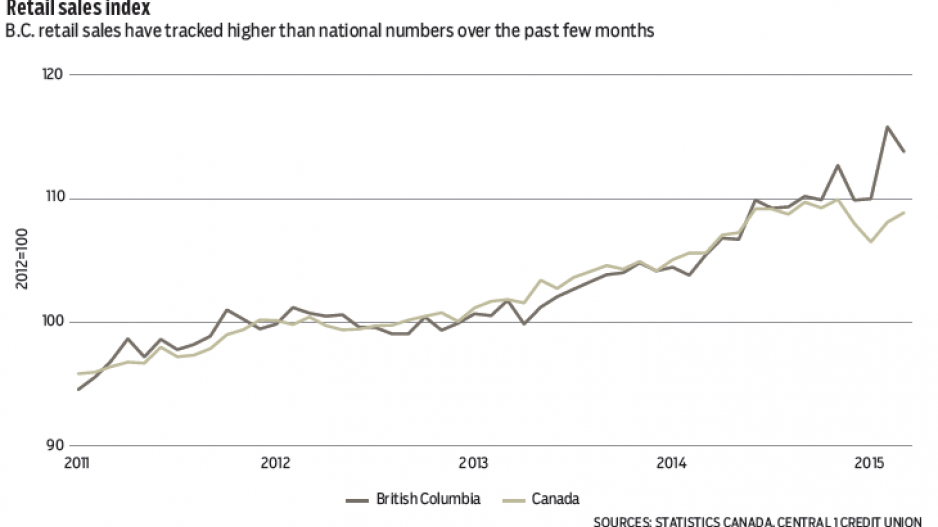

British Columbia’s spending growth has been blowing the rest of Canada out of the water this year. National growth was 1.8% with Ontario at a distant second with a 3.9% gain.

On a year-to-date basis, sales volume growth is being led by housing-related retailers with furniture and furnishings up 19% and building materials 32% higher.

Meanwhile, motor vehicle and parts sales are up 14% despite a March dip.

Retail gains reflect improving economic conditions that include healthy home sales and tourism trends that belie recent labour market estimates.

Retailers are also benefiting in part from the lower Canadian dollar.

While import costs are on the rise, there is less leakage to the U.S. as shoppers are staying nearer to home, given the less favourable exchange rate.

Retail sales growth is anticipated to remain strong this year at nearly 5%. •

Bryan Yu is senior economist at Central 1 Credit Union.