Pacific Network Services Ltd. and its affiliates have been effectively paralyzed and the company’s Vancouver headquarters is reported to have laid off staff.

PacNet is still in business, although the website for one of the affiliates – the Payment Factory – says the company “is no longer offering services,” and, according to one former PacNet employee, who did not want to be identified, the company has laid off roughly 80 employees in Vancouver.

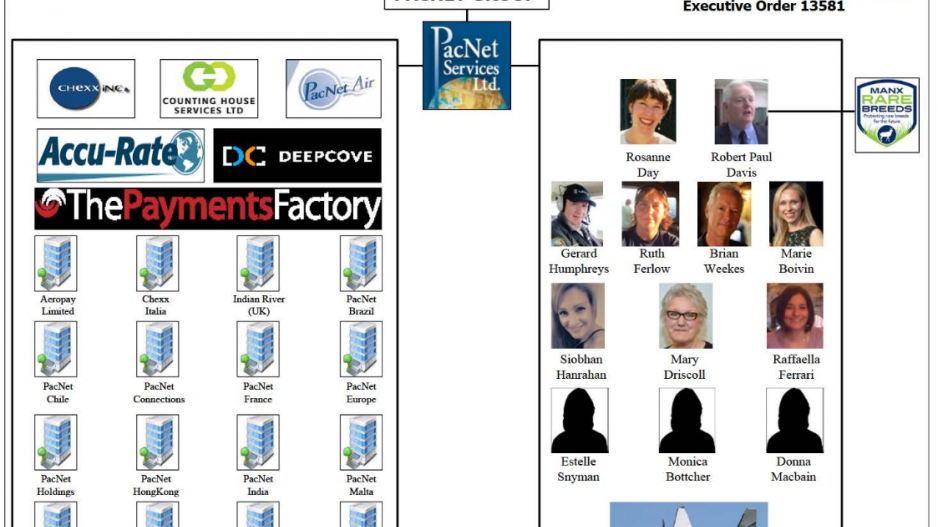

PacNet was founded by Rosanne Day in Vancouver in 1994 and grew into one of Canada’s most successful third-party payment processors. But its alleged dealings with mail-fraud scam artists drew the ire of the U.S. Department of the Treasury.

On September 22, the Treasury Department’s Office of Foreign Assets Control (OFAC) designated PacNet and 24 of its affiliates as a transnational criminal organization and began freezing its assets in the U.S.

Since most if not all wire transactions in U.S. dollars go through American banks, the sanctions have paralyzed the company’s ability to perform its core business of moving money.

“They are intended to be crippling,” said Christine Duhaime, a Vancouver lawyer specializing in counterterrorism financing and money laundering. “There’s no doubt that’s the intent, and they’re super effective if it’s an American sanction.”

The repercussions of the sanctions have reached financial sectors in Ireland and Israel. The Financial Conduct Authority (FCA) in the U.K. recently noted that, as a result of the U.S. sanctions, some payments to customers and direct debits have not reached creditors.

Despite that, the FCA confirmed that PacNet and its Vancouver affiliate, Counting House, both continue to be properly authorized as payment institutions.

According to the OFAC, Counting House is “owned or controlled” by Paul Davis, who lives in the U.K., although it is based in Vancouver.

From webcam pornography sites to electronic gaming, the U.S. sanctions appear to have sent ripples through the world’s commercial grey zones.

As a result of the freeze on assets in the U.S., PacNet and its affiliates have stopped processing payments for direct mailers, and its affiliates working in other areas also have had to cease facilitating some transactions.

Counting House, for example, which serves the electronic gaming space, has ceased processing payments.

UnionPay, a Chinese bank card company, has cut its ties with PacNet, which had provided UnionPay processing services that allowed Chinese cardholders to buy Canadian goods.

“To avoid any compliance risks, we have terminated our co-operation with PacNet,” UnionPay said in a written statement to Business in Vancouver.

Rosanne Day, PacNet’s president, would not confirm reports of layoffs and has declined to be interviewed.

The company’s lawyer, Jeff Ifrah, has said in a written statement that PacNet “denies the false allegations made by the U.S. government about its payment processing services for direct mailers.”

He also said stories by CNNMoney and other media outlets are “inaccurate and biased.”

“Although the current legal situation precludes further commentary, the company intends to vigorously defend itself and restore its excellent reputation,” Ifrah wrote.

But Duhaime said the company will have a hard time surviving the U.S. sanctions.

While the sanctions make it hard for PacNet and its worldwide web of payment processors to make U.S. transactions, it may still be possible for them to conduct transfers in other currencies, like British pounds and euros, if they are done between banks outside the U.S.

“It’s meant to really shut them down and make sure they can’t harm anybody anywhere,” Duhaime said. “So it’s going to be hard to imagine that they can continue, unless they go to apply to have the sanctions lifted.”

The U.S. sanctions arose from a specific type of business that PacNet and its affiliates served: processing payments for direct mail schemes, such as sweepstakes and psychic scams, some of which targeted the elderly.

PacNet says it has ceased doing any business with direct mailers. But, according to PacNet, direct mailers accounted for only 10% of its business.

PacNet or its affiliates also provide services to enterprises in electronic gaming, binary options trading and retail foreign exchange brokers.

One company that appears to have felt the impact of the sanctions is Chaturbate, a porn site that hosts webcam models. It appears the U.S. sanctions resulted in delays in paying Chaturbate models.

Chaturbate did not use PacNet directly, but one of the processors it does use – a Montreal-based company called Paxum – used Chexx Inc., a Vancouver-based affiliate of PacNet, for some services.

“Paxum only used Chexx Inc. [PacNet] as a third-party payment provider for check and EFT [electronic file transfer] withdrawals, and as a result of the allegations and current U.S. government investigation, we have ceased all business with Chexx Inc.,” Paxum wrote in a notice to Chaturbate clients.

Even if PacNet can avoid the U.S. banking system and find ways to move money in other currencies, international transactions go through the SWIFT network (Society for Worldwide Interbank Financial Telecommunication), Duhaime said.

“SWIFT also complies with the U.S. sanctions, so if it’s not through correspondent banking, then through SWIFT – wiring of funds – they’re going to have a difficult time moving money,” Duhaime said. “I would not be surprised if their Canadian accounts, if they have any – which they probably do – aren’t shut down just as a result of the U.S. sanction.

“The allegations from the U.S. suggest some criminality, and that means Canadian banks are probably going to be reluctant to have dealings with them, because they don’t want to be fined in case any money comes from a U.S. financial institution.”