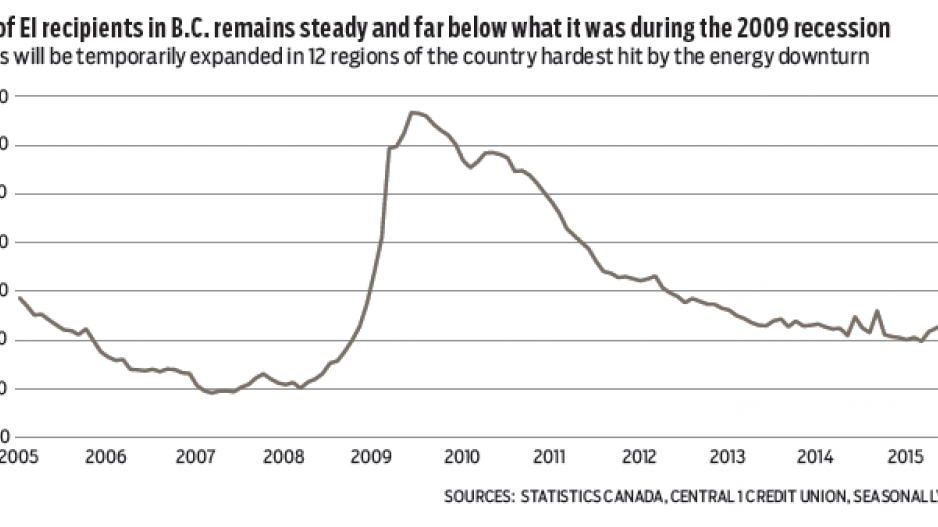

The number of B.C. residents receiving employment insurance (EI) benefits remained range-bound in January, edging slightly lower from December by 1.3% to a seasonally adjusted 53,110 individuals, but up 6.1% from a year ago. Nationally, EI counts were flat month to month, and 7.1% higher than a year ago.

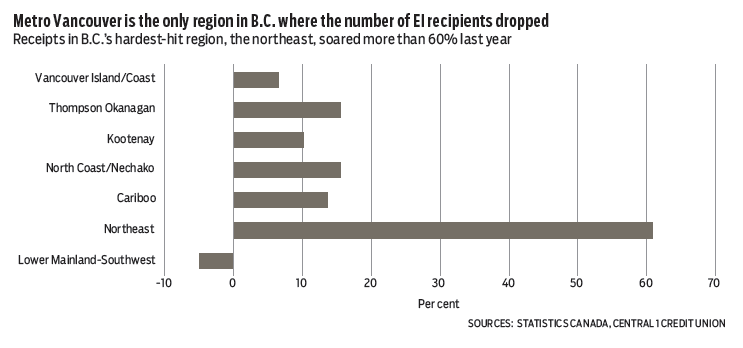

Relatively low EI counts align with positive provincial employment growth trends, but differences among regions underscore regional economic disparities. In the Lower Mainland, EI counts are down 5% from a year ago. In contrast, counts have surged in northern markets and align with a period of high unemployment. Low prices for metals, minerals and natural gas have hurt local investment, while oilsands cutbacks in Alberta are affecting workers commuting from other regions of the country. EI counts are up 60% from a year ago in the Northeast, while the Cariboo and North Coast/Nechako counts are up close to 15%. In the Kootenay region, increases are concentrated in the East Kootenay area (26.9%). Other Interior markets are faring only mildly better, with growth of 15% in the Thompson Okanagan. Vancouver Island is relatively steady, owing to stronger growth in tourism and housing this year.

The 2016 federal budget offers relief for some of B.C.’s challenged areas. EI benefits will be temporarily expanded in 12 regions of the country hit hardest by the downturn in the oil sector, including northern B.C., although other areas hurt by the commodity downturn will be left in the cold.

The construction sector continues to generate stronger economic news as housing starts and building permits drive increased residential investment and, ultimately, economic growth.

Estimated residential investment spending in new B.C. buildings jumped 2% from December to a seasonally adjusted $773.2 million in both current-dollar and inflation-adjusted terms. Year-over-year, current-dollar (or real) investment was 14.2% higher, although rising prices have added to the gain, with real growth a more subdued but still elevated 10.3%. Among product segments, year-over-year current-dollar investment growth was highest in the apartment sector at 30%, with a 9% gain in townhomes/duplexes and a 4% rise for single-family dwellings. •

Bryan Yu is senior economist at Central 1 Credit Union.