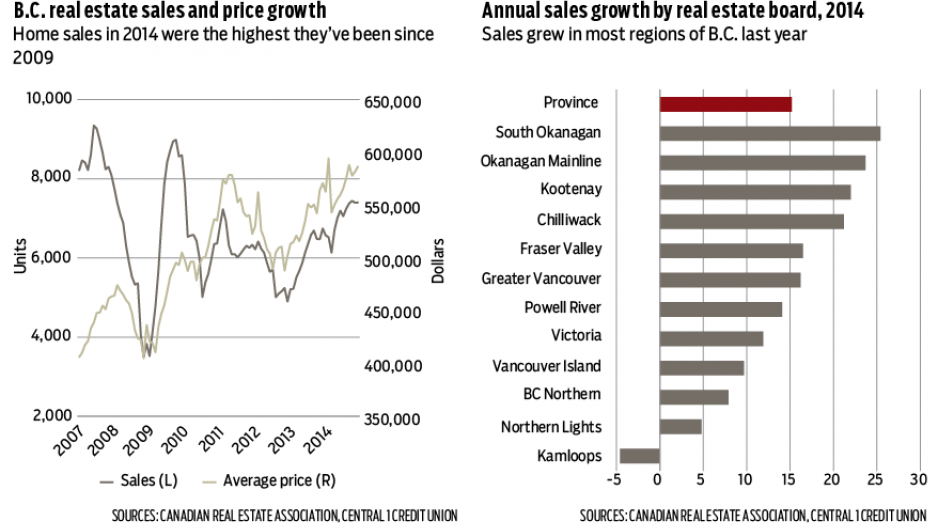

BC’s housing market ended on a solid note in 2014 with sales near multi-year highs. According to the latest data from the Canadian Real Estate Association (CREA), Multiple Listing Service sales reached nearly 7,400 units in December, which was nearly identical to November’s performance. Year-over-year growth in sales was 14.5%. |

Among regional real estate board areas, a monthly gain in the Okanagan Mainline (19%) was offset by declines elsewhere in the province, particularly in South Okanagan and Victoria. Despite moderation in some markets during the month, sales in nearly all markets in December were well ahead of the same month in 2013, reflecting a strengthening of housing demand through 2014.

Annual sales finished 15% ahead of 2013 at about 84,000 units. This was above the 10-year average but below the highs of the mid-2000s. Sales growth was led by a 16% gain in Lower Mainland markets, while gains in the Okanagan and Kootenay markets surpassed 22%.

While annual sales levels were generally modest, the housing market enters 2015 on solid footing. Stronger demand, lifted by low mortgage rates and modest improvements to the economy, has pushed the trend into the range last seen from 2005 to 2007. This gain, along with a mild pace of new listings activity, has pulled inventory levels lower and contributed to tighter market conditions. A scan of sales-to-active-listings ratios points to a balanced market for the province as a whole, with seller’s-market conditions in the Lower Mainland and Victoria. There are still pockets of weakness. Despite stronger sales gains, the Kootenay and South Okanagan still had excess supplies of inventory.

Tighter market conditions contributed to price growth of about 6% in 2014 to an annual average of $568,400; December’s seasonally adjusted monthly average reached $586,670. The CREA MLS Home Price Index and median prices suggest mild to modest price appreciation last year.

B.C.’s housing market is forecast to show further improvements this year due to stronger employment growth and persistently low interest rates. Sales will rise 5%, with a climb in the average price of 3%. The recent plunge in the price of oil is a risk to regional markets in the province. While the lower price keeps money in the pockets of households, it could cut into recreational demand as Alberta buyers restrain discretionary spending and also negatively affect B.C. residents who work in the oilsands.

Bryan Yu is senior economist at Central 1 Credit Union.