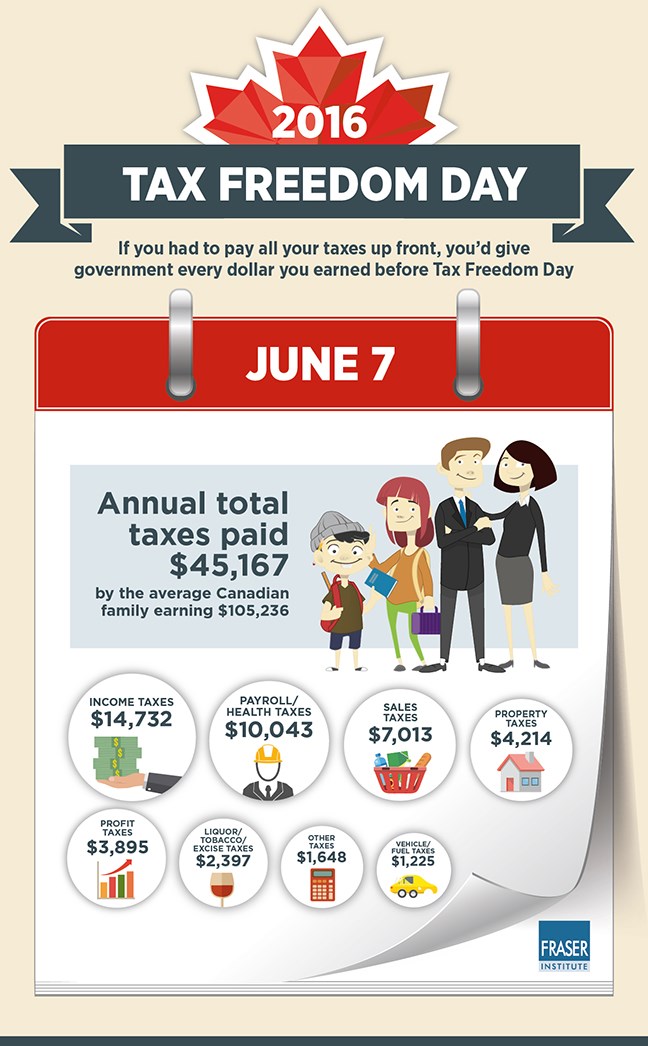

Today (June 7) is Tax Freedom Day—the day Canadian families have made enough money to pay all their tax bills for the year as levied by all levels of government—according to a Fraser Institute report released this morning.

The think tank said this means that if Canadians had to pay all their taxes up front for the year, they would give every dollar they earned prior to today, making June 7 the day “when families start working for themselves, not the government.”

“Taxes take 43% of our incomes, yet that’s not enough to satisfy the spending habits of governments in Canada who will collectively spend $47 billion more than revenues allow this year,” said study co-author Charles Lammam, director of fiscal studies for the Fraser Institute.

“If governments further increased taxes to balance their budgets instead of financing expenditures with deficits, Tax Freedom Day would arrive 11 days later.”

The report used $105,236 as the average Canadian family income, with an average total of $45,167 in total taxes being paid for the year.

Tax Freedom Day is a little earlier this year than last year, when it fell on June 10. But this change isn’t due to any major tax reductions, according to the institute.

“This year, 2016, is a leap year, which means Tax Freedom Day comes one day earlier,” the report said. “And because Tax Freedom Day is calculated based on federal and provincial tax revenue forecasts, overly-conservative revenue estimates by governments moved the date earlier up the calendar.”

Taxes included in the calculation include income taxes, payroll taxes, property taxes and taxes on sales, fuel licences and alcohol and tobacco.

Tax Freedom Day takes place on different days for each province. In British Columbia, it came earlier than average, on June 5.

@EmmaHampelBIV