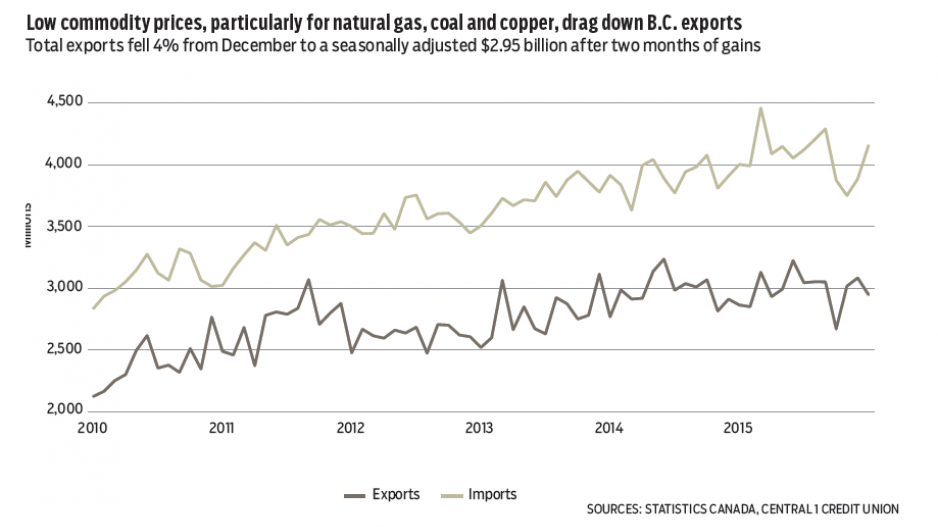

B.C. goods exports to international markets held steady again in January but underperformed national growth. Total exports fell 4% from December to a seasonally adjusted $2.95 billion after two months of gains, but held above year-ago levels by 2%. Canada-wide, exports climbed 1% from December and 7.3% from a year ago. B.C.’s monthly decline reflected steep drops in food-related exports and mining products, offsetting gains in forestry products and consumer goods.

While year-over-year gains are disappointing, low commodity prices are the key drag, particularly for natural gas, coal and copper. B.C.’s terms of trade have taken a hit, but estimated real export shipments (which are more important for economic growth) were up more than 5% from a year ago. Export trends should improve through this year and next, driven by the low Canadian dollar and strengthening U.S. demand.

On the housing front,home sales and prices shattered records again in February with Multiple Listing Service (MLS) sales in the combined Metro Vancouver and Abbotsford-Mission region rising 50% year-over-year. After adjusting for the addition of leap-year Monday, sales reached a record pace of about 6,850 unit sales for the month, up 5% from January and 45% from a year ago. Drivers of strong demand include strong employment gains, low mortgage rates, international purchases due in part to a low Canadian dollar and buyers racing to beat higher minimum down payment requirements in February.

Prices continued to track higher in response to demand, driving the MLS benchmark price index to above $700,000. While month-to-month growth slowed to 0.8% – a tiny sliver of good news for buyers exhausted by the seemingly perpetual acceleration in home values – prices were 21.5% ahead of a year ago. Price deceleration reflected a slower sales pace for detached homes and a dip in apartment prices as townhomes rose 2.4%. Year-over-year gains continued to be led by a 25% increase in detached-home values, with both townhomes and apartments rising about 16%.

With sales continuing to outpace listings, weaker price growth could signal that buyers are increasingly running up against their budget constraints with skyrocketing prices that are well outpacing income growth. Price appreciation will continue given a severely undersupplied market but is likely to decelerate as higher minimum down payment requirements and high price levels bite into demand and an increased supply of new listings comes to market.•

Bryan Yu is senior economist at Central 1 Credit Union.