Despite the city’s notoriously damp climate, it seems Vancouver consumers are not saving for a rainy day.

Just in time for the holiday season, consumers in this city managed to rack up an additional 0.5% in consumer debt in 2014’s third quarter. Year-over-year, the average debt load is up 1.0%.

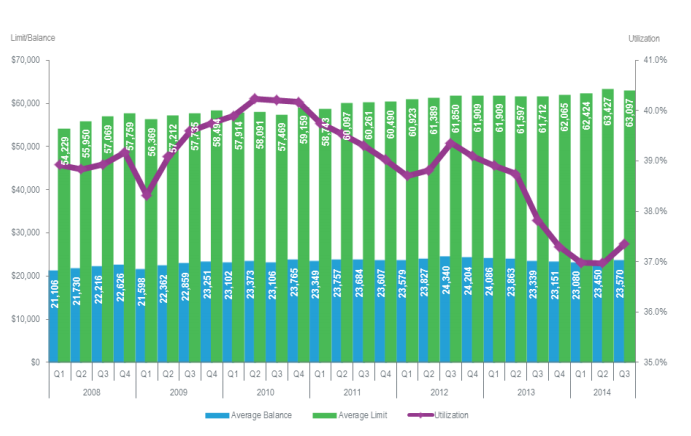

As of the end of Q3, the average Vancouverite holds $23,570 in debt, not including mortgages. This is almost 13% higher than the national average of $20,891, which is up 2.7%.

Chart: Average debt for consumers in Vancouver. Source: Equifax

Canadians owed a total of $1.518 trillion in consumer debt – an increase of 4.5% over last quarter’s $1.448 trillion, and up 7.4% from a year ago ($1.409 trillion). This will likely jump in the year’s final quarter.

"Following a frenzied start to the festive shopping season with more to come in the countdown to Christmas, we can expect the consumer debt to rise even further," said Regina Malina, senior director of decision insights at Equifax Canada. "'Tis the season, so we can anticipate credit cards getting a strong workout throughout December."

Calgarians carry the country’s highest debt loads, with $28,244 on average, per person. Edmontonians come in second at $26,419. The city with the lowest debt per consumer is Montreal, at $15,956.