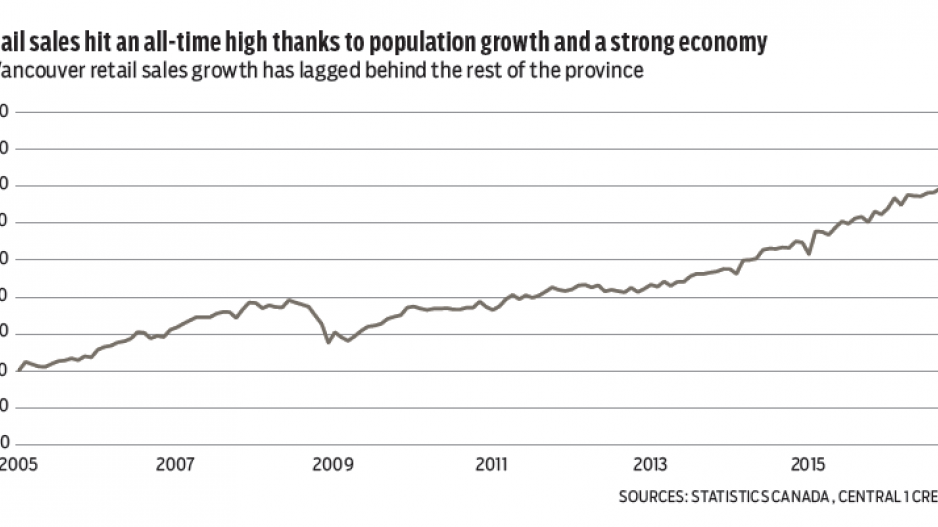

B.C. retail sales growth led the country by a large margin in May, advancing 2.6% over April to above $7 billion. This compared to a 0.6% national gain. Year-over-year growth accelerated from April to 9.9%, which also led the country.

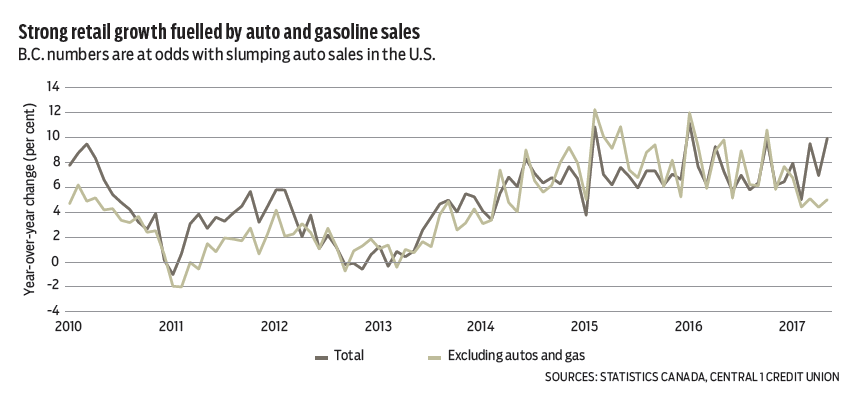

Most retail segments gained traction, led by auto purchases and building-material sales. New and used vehicle sales growth jumped 28% year-over-year, compared with a 3.2% same-month gain in April. Building-material and garden-related sales rose 30%.

Other key drivers of the acceleration included clothing sales and health and personal-care stores. Gasoline sales rose 17%, but decelerated from recent months on retreating prices.

While growth is unsustainable at this pace, high retail spending reflects strong levels of consumer demand driven by high levels of job growth, low interest rates, housing demand and outside inflows of income from tourism. Year-to-date sales reached 7.8%, which was near the top among provinces.

Sales growth in the Vancouver census metropolitan area, at 6.7%, trailed the rest of the province.

Excluding vehicle and gasoline sales, and the effect of big-ticket items and volatile gas prices, growth was a solid 5% through five months, pointing to strong underlying demand. Full-year total retail sales growth will remain strong but ease to 5.9% from 7% in 2016.

International tourism to B.C. fell back after an April surge but remained elevated in May. Total entries to B.C. reached a seasonally adjusted 472,806 persons, down 2.9% from April, but elevated at the first-quarter trend level.

A retreat in the number of overseas visitors drove the decline as visits from the U.S. climbed.

Despite monthly fluctuations, the inflow remained higher than at any time since 2000 and a significant driver of economic dynamism in the province owing in large part to a low Canadian dollar.

Year-over-year inflows were up 3% in May, and 3.5% through the first five months of the year.

Overseas visits, specifically from regions like China, Mexico and the U.K., are at a record high and are up 13% on a year-to-date basis.

U.S. visits have slipped through the first five months but continue to track the highest levels since the early 2000s.

With a slight firming in the Canadian dollar expected, albeit holding within the US$0.76 to US$0.80 range, tourism will remain a positive source of income flows and retail spending in the province, providing a boost to economic growth through 2017. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.