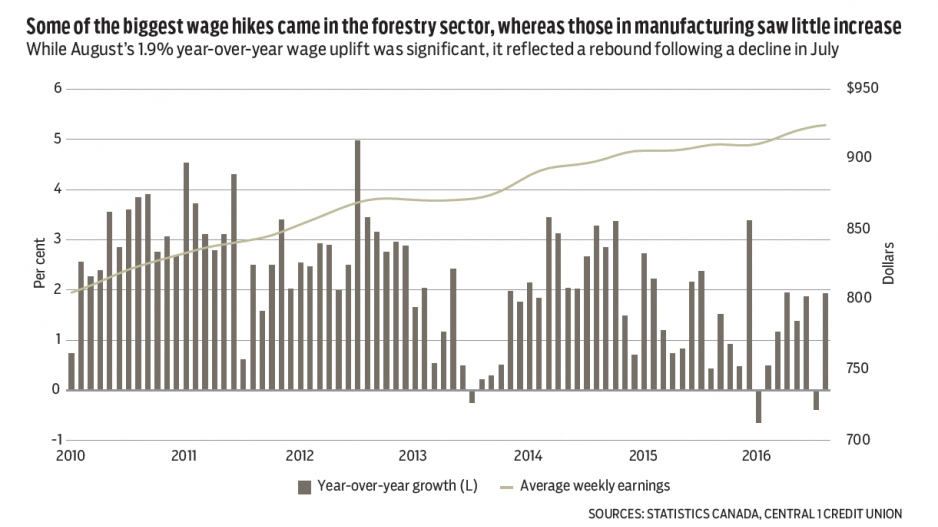

Average weekly earnings in B.C. jumped in August to $924 (seasonally adjusted), a gain of 1.5% from July and 1.9% from a year ago.

Both the goods- and services-producing sectors had month-to-month gains in line with headline growth, but goods-oriented pay rose 2.7% from a year ago while wages in the service sector climbed a milder 1.7%.

Nationally, weekly earnings rose 0.8% to $960.50, up 1.6% from a year ago.

While August’s wage uplift was significant, it reflected a rebound following a July decline. Weekly earnings in B.C. continued to trend range-bound, with the average gain over the first eight months a relatively disappointing 1%.

On average, year-to-date wages in goods-producing sectors were generally unchanged from a year ago, with significant growth of about 4% in forestry and logging wages being offset by a lower gain in mining and construction.

The service sector has fared better but overall wage growth has remained low at about 1.2%.

Low earnings growth comes despite rapid employment gains. Paid employment in B.C. climbed 3% in August on both a year-over-year and year-to-date basis, generally aligning with Labour Force Survey estimates and far outpacing the rest of the country. A gain of this magnitude would normally generate higher wage growth than we’ve seen.

Retail sales in B.C. were unchanged in August from July at $6.25 billion (seasonally adjusted), but still fared well compared with a mild decline of 0.1% nationally.

Year-over-year sales growth in the province slid to a still-solid 5.1%, with a year-to-date gain of 6.5%, far outpacing national gains of 1.6% year-over-year and 3.7% year-to-date.

Strong gains in the province thus far and a still-positive sales trend point to strong consumer demand driven by robust employment gains and population growth, as well as high levels of tourism.

However, momentum has slowed since the spring, when annualized monthly sales growth trended near 7%, to more recent trends of near 1.5%.

This shift likely reflects a downdraft in B.C.’s real estate market following a spring frenzy, which has contributed to decelerated sales growth in related products. •

Bryan Yu is senior economist at Central 1 Credit Union.