Inequality is a tricky thing to tackle, but economists say the new Liberal governments’ proposed policies on taxation and benefits will help rebalance the scales.

“Here what they’re trying to address is inequality between the lower and middle class compared to the richer,” said Steeve Mongrain, an economics professor at Simon Fraser University.

“I think this will be relatively successful.”

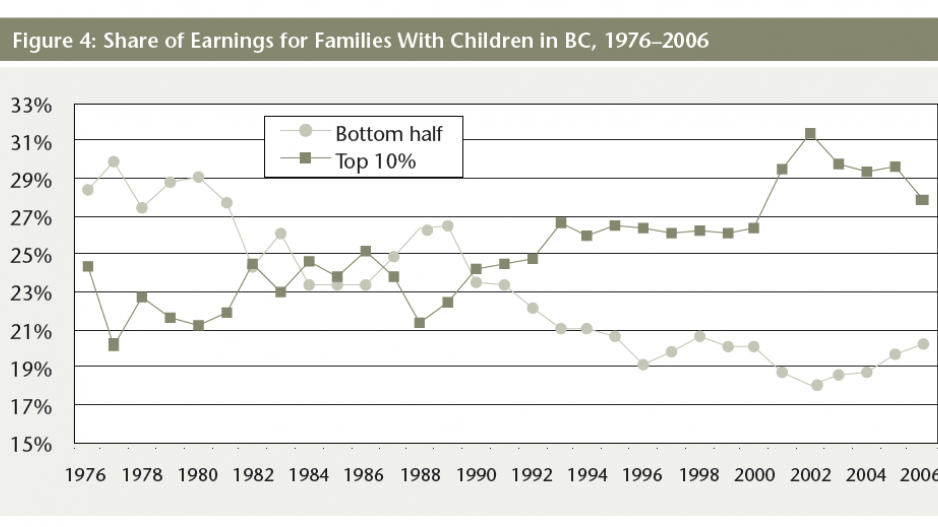

Since the 1980s, inequality has been rising throughout the developed world, including in Canada, and British Columbia has the highest rate of inequality among Canadian provinces.

Economists have warned that while modest levels of inequality are positive, the widening gap could pose a threat to economic growth: inequality can stifle innovation, stall social mobility and slow overall economic growth.

The Liberals plan to reduce the federal income tax rate from 22% to 20.5% for people who earn between $44,700 and $89,401, while introducing a new tax bracket at 33% for those who earn over $200,000.

The Liberals have also pledged to scrap the Conservatives’ controversial income-splitting system, which the Conservatives said would benefit most families but which most benefited high-income earners with spouses in a lower income bracket. The Universal Childcare Benefit, a taxable benefit of $100 a month, per child, will be replaced by a non-taxable benefit directed at families who earn less than $150,000.

“You end up giving rich people a cheque of $100 per person per child, and tax it - why bother?” Mongrain said.

“I think the idea of moving to something that’s non-taxable is a great idea, because labour supply is so tied with fertility decisions.”

In regards to “fertility decisions,” the Liberals are not proposing a national childcare plan, as the NDP were. An affordable childcare program should be a key part of the push to reduce rising inequality, Seth Klein and Shannon Daub of the Canadian Centre for Policy Alternatives wrote in a commentary.

In a 2014 report, TD Bank economist Craig Alexander and Francis Fong wrote that globalization and technological change have played a big part in rising levels of inequality. But they also note that while the federal government cut back social programs and transfers to provinces in the 1990s in order to pay down the large deficit of the time, governments have since tended to put policies in place that most benefited higher earners.

Critics of taxing higher earners say such policies could make Canada less competitive, especially compared to the United States, and motivate wealthy people to look for ways to shield more of their income from taxation.

“We’re going to end up in most provinces with marginal tax rates up at the 50% level or above so I think that’s somewhat concerning in our ability to attract top talent,” said Jock Finlayson, chief economist and executive vice-president at the Business Council of British Columbia.

“Like many economists I’m a bit dubious of pushing tax rates on individuals of 50% or higher, which is what this will do.”

Both the Liberals and NDP said they would close loopholes that allow high-income people to set up Canadian Controlled Private Corporations — an option increasingly popular with professionals like lawyers and doctors — and pay less tax.

“We’re talking about a 4% increase, so I don’t think it will have the effect of scaring rich people and sending them to other countries,” Mongrain said of the tax changes for those earning over $200,000 a year.

Putting more money in the pockets of the middle class is expected to benefit the local economy, as lower earners tend to spend money close to home rather than investing it or spending on luxury items such as travel.

“Back of the envelope calculations suggest that there could be a lift of a bit less than 0.2% of GDP due to the greater propensity to spend rather than save at lower income brackets,” wrote Avery Shenfeld, chief economist for CIBC, in a note to clients.

Shenfeld said it was possible that higher marginal tax brackets at upper income levels could have a downward effect on economic growth, especially considering that some provinces have also recently raised rates on high earners.

“But one has to be careful about claiming economic ruination from such higher brackets,” he added. “According to the independent Tax Foundation, in 1963, the top marginal federal tax rate in the US was 91%, and as late as 1981 it was 70%.”

@jenstden