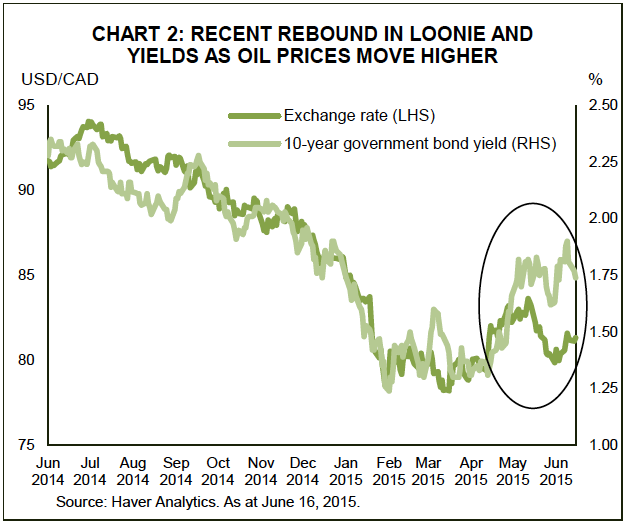

Recovery will be slow, but we’ve weathered the worst in terms of a poor economic climate in Canada, according to TD Economics’ quarterly economic forecast.

Real gross domestic product (GDP) in Q2 is forecast to grow 1%, and will grow 2.5% in the second half of the year. This will mean annual growth of 1.6% overall, and 2016 will see further expansion of 2.3%.

“It is our view that the worst is likely behind us,” TD said in its report.

“Although the impact of lower oil prices on corporate profits and business investment are forecast to persist in the near term, the anticipated boost to exports from a lower Canadian dollar and resurgent U.S. economy should pave the way to better growth numbers.”

The first quarter of 2015 saw the economy shrink for the first time since 2011 due to “external developments.”

“Soft U.S. demand to start 2015 delivered a powerful blow to an economy already reeling from a sharp decline in oil prices,” the report said.

Despite this positive outlook, TD expects household spending to remain relatively low.

“The benefits of low interest rates on household spending will face a counterweight from muted job creation and wage gains, as the hangover from plummeting oil prices lingers in the labour market,” the report said, going on to say employers will still be in belt-tightening mode, at least over the short term.

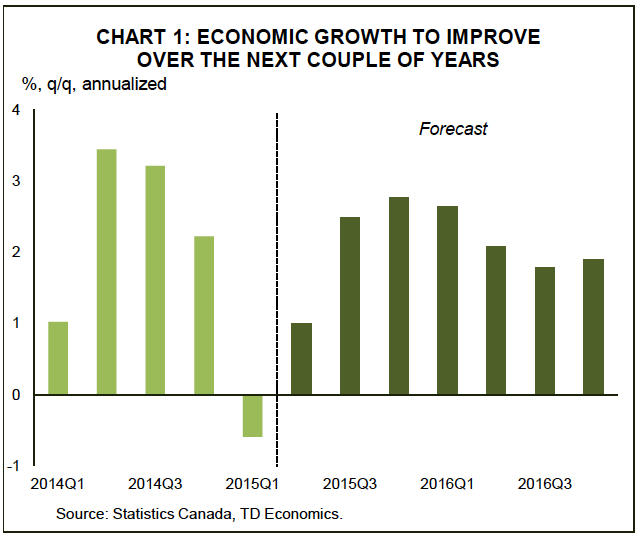

This means personal income will see little growth this year, but there will be improvements over the next few quarters as oil prices rebound.

Household debt remains a strong factor in future spending.

“Households have slowed their debt growth more in line with income and we see that trend continuing as pent-up demand for consumer durables (i.e. autos) has largely been satisfied,” TD said.

Interest rates are expected to move upward, which will dampen housing resale activity

Overall, a strengthening U.S. economy – and, in turn, a growing U.S. dollar – will contribute to downward pressure on the Canadian dollar.

“Thereafter, financial markets will likely refocus on the upward trend in oil prices couple with a shortening runway on expectations for a Bank of Canada rate hike,” said the report.

“This should provide offsetting influences that pull the loonie towards 85 cents U.S. by late 2016.”