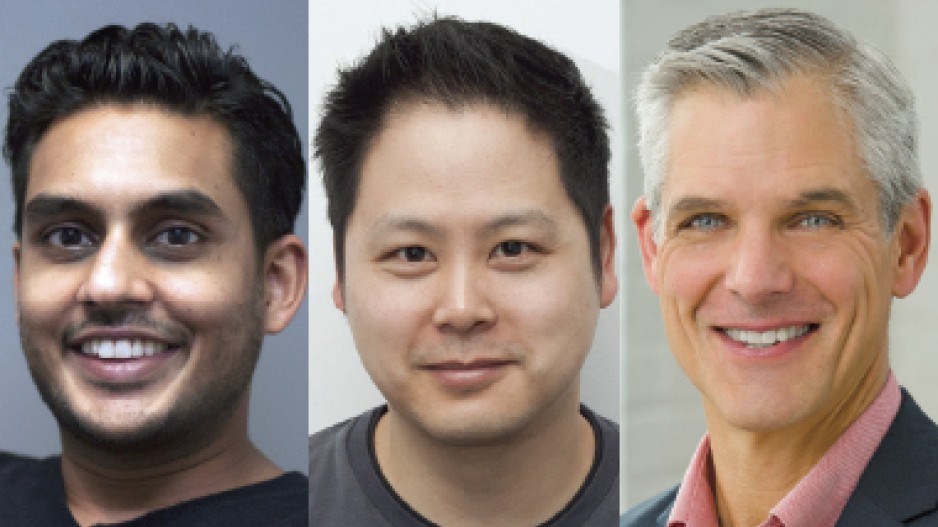

Kevin Sandhu - CEO, Grouplend

With the rise of social media and mobile technology comes a wealth of data, driven by the shift in human communication patterns towards increased sharing of personal information online. Whether it’s demographic, psychographic or behavioural, this data and information is incredibly valuable. A person’s social footprint is like his or her physical fingerprint: it is wholly unique. Our ability to collect this digital individuality is now time-effective and cost-effective enough that we can begin to effectively analyze it to drive real value back to the consumer.

Whether it’s assessing creditworthiness to offer more fair and precise interest rates or vetting clients from a fraud perspective to ensure that they haven’t assumed someone else’s identity, the smartest financial technology (fintech) companies have started to incorporate unconventional social-media-based analytics into their processes. From Grouplend’s perspective, we do all of those things just mentioned, but we are looking a layer even deeper than that. We use social media to personalize a client’s experience with us, making sure that the services we’re providing are in line with the unique needs and demands of the clients using our products and services. Based on the data that we are able to collect from the numerous social channels and platforms available to us, we are able to know an amazing amount about a client’s likes, dislikes and lifestyle. One example: from their social media data, we might learn that some clients are fans of Starbucks, so we send them a handwritten birthday card with a Starbucks gift card attached. This can all be done in an automated, intelligent way that lowers our operating costs and, more importantly, allows us to deliver a truly personalized service to our clients.

Rod Hsu - President, nTrust

Financial tech is an exploding sector with many parties racing to move with the times. Understanding how and why this change in the fintech space is happening will ultimately result in a better, more accessible product for the end-user. Recent research points to the millennial generation as the drivers of this innovation, as their behaviours shift in accordance with innovation in fintech.

Millennials have a uniquely progressive view of future financial conditions. They, in particular, are most likely to envision a cashless, sharing-based economy in the future where banks no longer serve as their primary financial institutions. In fact, many millennials are early adopters of financial products and services from outside the industry. With the highest adoption of near-field communication mobile payment platforms, millennials far outpace their generation X counterparts by more than three times.

Social networks are a must-have for any financial institution that wants to win over millennials. Millennials trust their social networks and turn to them twice as often as their gen-X counterparts for financial news, guidance and advice. With the advent and rise of social media, data sharing and data collection have spread like wildfire and have become invaluable tools for building profiles of customer markets.

Millennials are forcing drastic changes to financial services providers’ business models and marketing strategies. The same social networks millennials use to access financial information can also help companies deliver personalized marketing and, in turn, ensure that innovation remains in line with consumer needs and wants. Innovation may start in a blue-sky tank, but the more we’re able to understand its applications and how this trends with the data, the better its chance of traction when rolled out in the marketplace.

Gary Fearnall - Canadian country manager, OnDeck

The fintech sector is marked by rapid innovation and is evolving at an exceptional rate. Catalyst Research Group most recently found that mobile adoption has increased by 24% in Canada since last year.

Findings like this are driving companies, including online lenders, to tailor their products and processes to satisfy their customers’ on-the-go needs. Social metrics and data are also proving to be an invaluable tool for increasing our understanding of new trends, and can help spark further digital innovation.

Online lending has been at the forefront of financial innovation, and it may not be an exaggeration to say that within the next decade financial services as a whole will be significantly transformed. Advancements in fintech are allowing companies to use data and technology to adapt to their customers’ needs faster and more efficiently than ever before.

At OnDeck, we use our OnDeck score to better assess business creditworthiness and provide the right financing for our small-business customers with a process that respects their time.

Among the 2,000-plus data points the OnDeck score evaluates is social data. We’ve found that social data can help to validate and substantiate business information submitted during the application process.

The rise of fintech and mobile innovation paired with increased customer reliance on digital solutions means even more evolution ahead in not just lending but also banking in general.

It’s clear that one-size-fits-all solutions are a thing of the past, so tailoring products and services to fit each customer’s specific needs is key to long-term success.