After a decade of turmoil – where revenues of even top-ranked companies have fallen 25% or more – commercial printers in Metro Vancouver are counting on an offline shift and new technology for survival in a tough business environment.

A series of studies, including a recent InfoTrends Inc. report, point to a continual erosion of the print industry due to the Internet and digital media. Generally speaking, commercial printing is in decline because so much of what was once recorded, transmitted and stored on paper is now being done electronically.

That is not news locally, where high labour costs, expensive equipment, software upgrades and fierce competition add to the challenges.

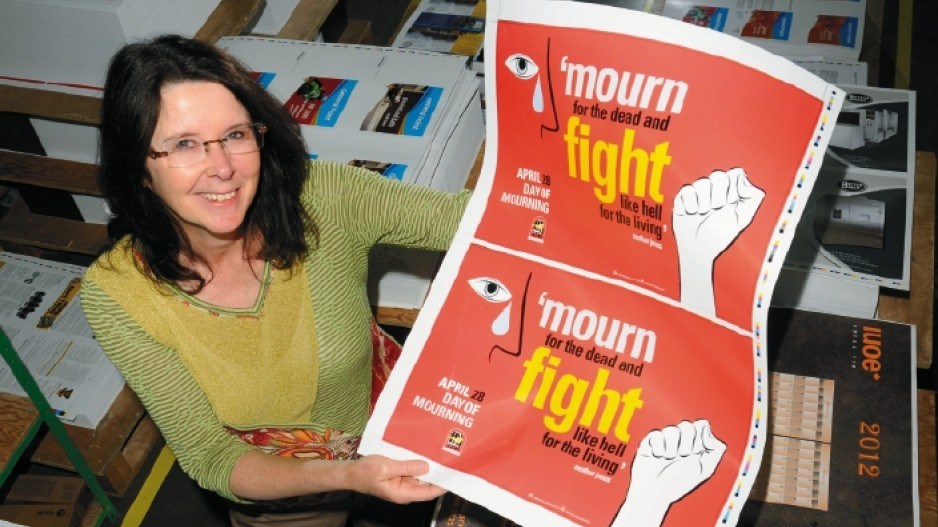

“Anyone who would get into the printing business today would have to be out of their friggin’ mind,” Kathy Forrest, president of family-owned Thunderbird Press Ltd. of Richmond, said with a characteristic laugh.

Thunderbird, a unionized company in business for 45 years, has established a niche in printing union material such as newsletters, posters and brochures and has just spent big on upgrading to digital press equipment. Still, Forrest estimates that profit margins remain around 5% in an industry vulnerable to offshore competition and leapfrogging technology.

“Capital expenditures and labour costs are huge,” said Forrest, who took over as president from her founding father five years ago. “You have to have a passion for this business.”

But passion alone won’t cut it, print expert and author Frank Romano told a recent meeting of the British Columbia Printing and Imaging Association (BCPIA). Noting that the number of commercial printers in North America fell from nearly 50,000 to 32,000 in the past eight years, Romano said it is only the most tech savvy – or acquisitive - that can make it today.

For instance, digital commercial printing is forecast to see 20% to 50% growth rates over the next four years, while analog printing heads in the exact opposite direction, said Romano, who has authored the industry’s most widely read manuals.

Coming on fast are wide-format printers – up to 16 feet wide – and advanced ink-jet printers, which require expensive new hardware; Flexform systems that can custom print on any surface; and 3-D printing, which could simply transform the entire industry. For many commercial printers, the choice is to get big or get out.

Service is king

Marilynn Knoch, BCPIA executive director, ticks off the recent mergers and acquisitions that characterize the B.C. print industry. In the past few months alone, Vancouver-based Pacific Bindery Services Ltd. bought specialty printer Arkwel Industries Ltd. of Vancouver; Chilliwack-based Sunrise Printing bought Westcoast Reproduction Centres in Vancouver; and Buchanan Printing Ltd. of White Rock merged with Parfour Signs, also of White Rock.

“We are regularly approached,” said Forrest, whose company swallowed a smaller competitor seven years ago. “It is so expensive to start or expand a print company that acquisition is often the only way to grow.”

Despite the challenges, commercial printers see potential beyond buying each other up, Knoch said. Former print clients who went with web-based promotions and flyers, she said, are seeing less response than from traditional printed materials.

“Consumers actually have to be looking for something online,” she said. “It is not right in front of them.”

As a result, advertisers are slowly coming back to direct-mail printing, she suggests. Also, clients lured by super low-cost online printing quotes – where material such as marketing brochures and business cards are printed as far away as China or India – are also finding that typos, low quality and poor service are negating any price advantage, she added.

“Service is all important today,” said Richard Kouwenhoven, vice-president of customer service and business development with industry stalwart Hemlock Printing Ltd. of Burnaby. That is the key reason why Hemlock, one of the largest sheetfed commercial printers in Western Canada, has retained most of its U.S. customers, including magazine publishers, in spite of an at-par dollar and fierce American competition, he said.

Even Hemlock, which keeps up to date with the latest equipment – and is now looking at new 3-D printing technology – has seen its annual revenues decline to $30 million from $40 million 10 years ago.

“2002 was a different world,” Kouwenhoven said. Still, he added, it is the overall stability of the North American economy, not gee-whiz technology, that will decide the fate of Hemlock – and the local printing industry – over the next decade. •