The federal government today announced nation-wide carbon pricing plan that will start at $10 per tonne, starting in 2018, and rise by $10 per tonne for four years to $50 per tonne by 2022.

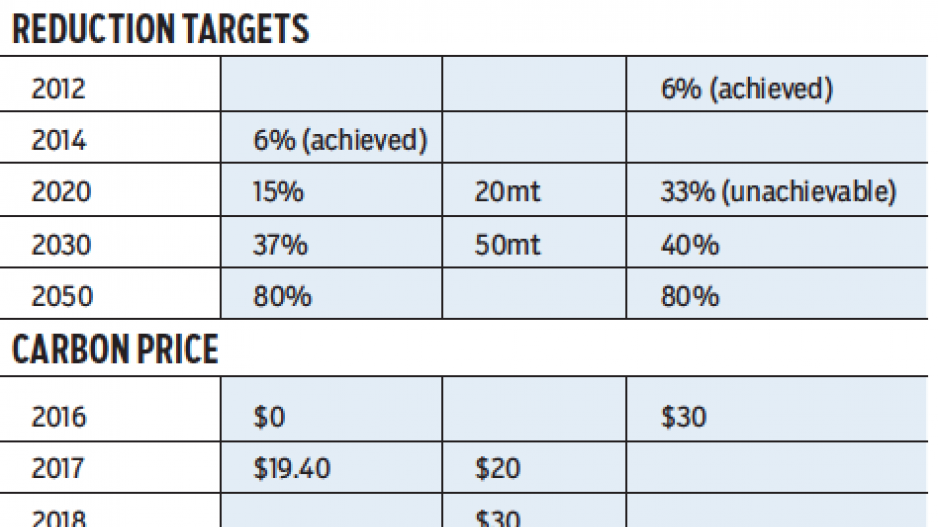

B.C. introduced a carbon tax in 2008 that started at $10 per tonne, rose to $30 per tonne by 2012, and has been frozen there ever since.

Premier Christy Clark has come under fire for ignoring her own Climate Action Leadership Team’s key recommendations, which included a commitment to start raising the carbon tax by $10 per year, starting in 2019.

The Clark government justified the continued freeze on the carbon tax by saying it wanted to wait until other jurisdictions catch up.

Under a new federally mandated benchmark, that means other provinces will not likely catch up to B.C. until 2020.

Provided B.C. plans to do the bare minimum required, it could wait until 2021 before it resumes raising the carbon tax by $10 per tonne per year.

Or it could start raising the carbon tax by $5 per tonne in 2019, and still meet the national benchmark.

The federal government is using B.C.’s carbon tax as something of a model for the sources of pollution it should apply to.

“At a minimum, carbon pricing should apply to substantively the same sources as British Columbia’s carbon tax,” a Government of Canada news release states.

Provinces that opt to go with cap and trade, rather than the carbon tax that B.C. and Alberta have adopted, will need to establish carbon caps that continue to decline annually between 2018 and 2022.

It will be up to the provinces and territories to decide what to do with revenue generated from carbon taxes or cap and trade.

British Columbia went with a revenue-neutral carbon tax, which means that for every increase in carbon taxes, there is an equal reduction in other taxes.

Alberta went with a model that will use carbon tax revenue – expected to raise $9.6 billion over five years – to finance public transit and renewable energy investments. Alberta’s carbon tax is scheduled to come into effect next year at $20 per tonne, rising to $30 per tonne in 2018.