The Canadian dollar has lost another $0.05 against the greenback since January, making Canada an incredible deal relative to a year ago when the exchange rate hovered near $0.90

Despite a mild January setback, tourist dollars are increasingly flowing into British Columbia’s economy as the bargain created by the lower Canadian dollar and the strengthening U.S. economy provides a lift to the area’s hotels, restaurants and recreational services, not to mention emerging services like Airbnb.

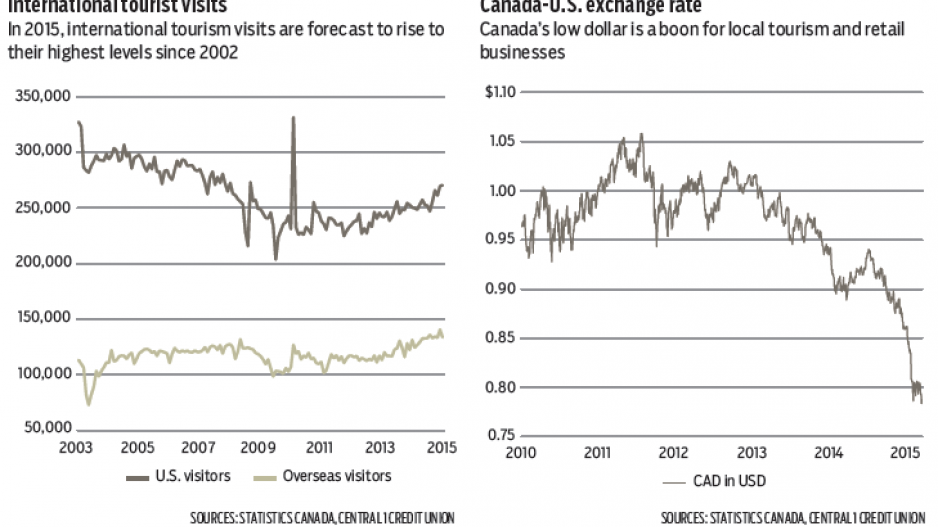

Total international tourist visits reached a seasonally adjusted 404,000 entries in January. While this was 1.5% lower than December, visits were nearly 6% higher than a year ago and trending at the highest level since 2007. Overseas visits accounted for January’s decline but continue to trend at near-record highs. Furthermore, momentum is increasing on the U.S. front as the number of Americans crossing the 49th parallel into B.C. reached the highest single-month pace since 2008 (other than during the Vancouver 2010 Winter Olympics). U.S. visits climbed to 270,400 tourists in January, up nearly 8% from a year ago.

Conditions are ripe for further gains. The Canadian dollar has lost another $0.05, or 5%, against the greenback since January, making Canada an incredible deal relative to a year ago when the exchange rate hovered near $0.90. This will drive gains from the U.S., not to mention from countries with currencies pegged to the U.S. dollar, including China. We forecast international tourism inflows to climb 7% to 4.9 million visitors this year, marking the strongest performance since 2002.

While tourism-oriented sectors are gushing with the low Canadian dollar, the depreciated currency is also a boon to the retail sector. With the decline in the loonie’s purchasing power south of the border, Canadian dollars are increasingly staying north of the border. Short-term vehicle trips to the U.S. of one night or less have dropped sharply since mid-year and were 18% down year-over-year in January – owing mostly to a drop in same-day travellers – a sign that the leisure traveller is finding it more difficult to justify a cross-border shopping trek.

Travel by other modes of transport, including air, was up on a year-over-year basis, but this more likely reflects business or longer-term vacations than shopping or recreation jaunts. •

Bryan Yu is senior economist at Central 1 Credit Union.