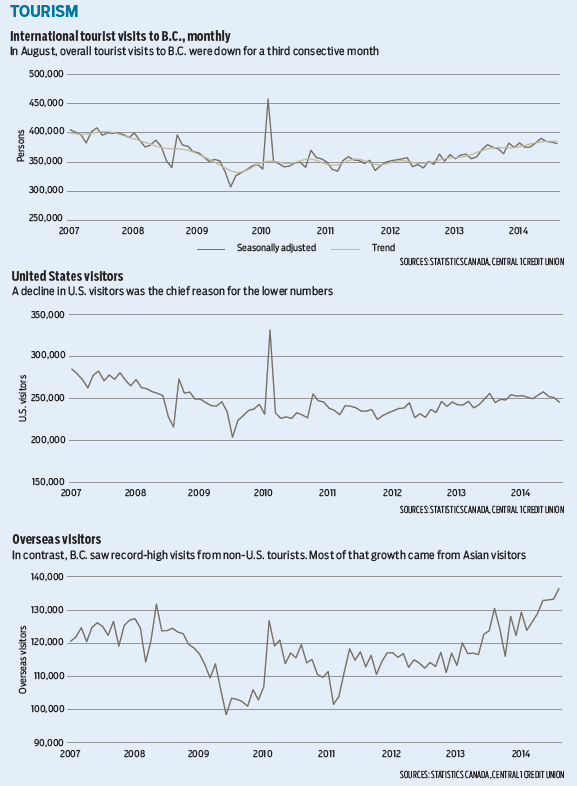

U.S. demand was the key dampener of travel during the month, falling about 2% to 245,370 persons.

While in line with a year ago, the pace of entries has stalled at a range-bound pace for most of 2014 despite modest, albeit uneven, U.S. economic growth. The recent slide has narrowed year-to-date growth to 2.6%, while the trend remains below 2000 levels.

In contrast to this lull, overseas visits to B.C. surged to a new record high in August. The pace of overseas visits jumped 2.4% during the month to a seasonally adjusted 136,500 entries, marking a lift of 4.5% from a year ago. Signs of a mild deterioration in global economic growth are yet to rain on the tourism parade as the year-to-date flow has grown nearly 9%.

While relative growth was strongest from North America (excluding the U.S.), Central America and the Caribbean, the vast majority of the gain came from Asia. Asian travel to B.C. represents about two-thirds of total overseas gains this year and is up about 12% from a year ago. Tourist flows from China are up 27%, accounting for most of the gain. India has also grown as a source country with growth of 20%, although this is off a considerably lower base. Even with slowing economic growth, these economies are growing enough to generate an increasing pool of middle- to higher-income households, which are fuelling global tourism demand.

In contrast, a weak European economy has contributed to stagnant travel demand to B.C., which was up only 3% from a year ago.Despite the recent lull in U.S. visits, the tourism sector is expected to generate traction through the remainder of the year. The continuing U.S. economic recovery and relatively low Canadian dollar are anticipated to drive higher flows from south of the border and add to the growth from overseas markets.

Total annual international tourist visits are forecast to rise about 5% to 4.64 million visitors this year. A further gain of about 7% is forecast for 2015. •

Bryan Yu is an economist at Central 1 Credit Union.