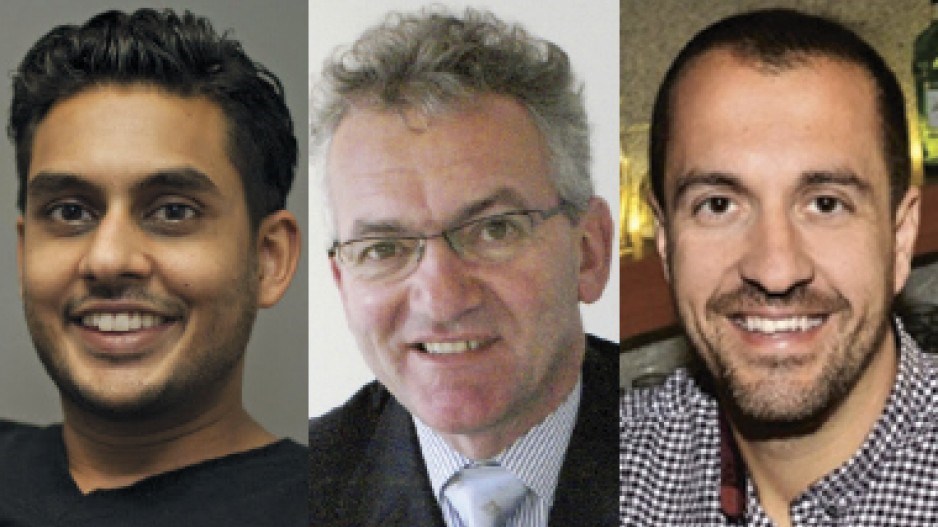

KEVIN SANDHU - CEO, Grouplend

Your business is thriving and you’re growing so fast you can barely keep up. But instead of throwing yourself a party to celebrate, you’re up all night worrying about how you’re going to pay for the additional inventory or cover the cost of new employees before all that growth turns into positive cash flow. Being tight on cash because of newfound growth might sound like a first-class problem, but it’s a problem. So what are your options? There are three primary sources of growth capital for a small business: • if the business is generating cash, operating cash flow can be used to fund growth; • new equity capital from the shareholders and/or outside investors; and • credit, either in the form of a business loan or a personal loan that’s used to fund business expenses. Each option has its advantages and disadvantages, but for most growing small businesses, the last option is at least a part of the growth-financing strategy. When comparing credit options, business owners and managers should consider more than just the stated interest rate. Other key variables to consider include fixed versus variable rate, prepayment and other hidden fees and covenants that might restrict the business’ ability to get additional financing in the future. Another thing to consider is whether it makes more sense to secure a business loan or take out a personal loan and use it to cover business expenses. While business loans might seem like the better choice, they often require significantly more paperwork, take longer to process and can require a personal guarantee anyway. With a growing number of alternative loan providers available, a personal loan could prove to be the best value and most convenient option for your growing business. |

BRENT CUNNINGHAM - Co-owner, Sequoia Mergers and Acquisitions

Before seeking funds for your small business, be clear on your objective. The funds are a commodity. What you want is to get the greatest return from the use of the funds; therefore, you need to ask yourself what added value accompanies the funds. Many of our clients are in a position where they want to take their business to the next level. They see plenty of growth opportunities, yet they’ve reached a point where they’re not willing to risk the level of personal capital required to take the plunge. In other words, they’d like to strategically add value to the business and create opportunities for their team, but they don’t want to be the one in charge of the day-to-day operations. This leads many to question whether there is a way to sell part of the business and still get a second bite of the apple when they’re closer to retirement. The answer for many business owners looking for funding to grow their business is to seek a source of private equity. There are many qualified sources that not only inject the needed growth capital into the business, but more importantly also deliver the following value-adds. They include: • connections to help fill seats with the right management team; • expertise to facilitate systematizing the procedures of the business to prepare it for growth; and • governance and strategic guidance to help open doors to new markets and opportunities. Ultimately, finding the partner with the right cultural fit is key to a successful private equity relationship with lower mid-market companies. |

BILL KERASIOTIS - Principal, Blueprint

This can be the hardest question to answer and the most challenging for any small-business owner at the beginning. A lot of great people have great ideas, but getting people to believe in you is another story. No one likes spending money on something that’s not proven. So here are some key funding considerations. Determine your goals for growth: spend time and identify where you want to go or what side of the business to grow first. Developing a clear long-term growth strategy and sticking to it allowed us to break everything down into a system of smaller tasks and identify where we needed to allocate funds to tick each one off. Pursue what comes naturally: focus on your strengths first and follow them with purpose. Following what came naturally to us allowed us to build up the necessary revenue and capital to acquire more staff, expand our team and pursue additional goals. From there, we knew the projects that we wanted to do and that made sense for us, and at that point, we were able to get some investors to come aboard. Consider strategic partnerships: be aware of who’s operating in your industry and be open to partnering or aligning your efforts with others who complement your business and can help you reach your goals, and use each other’s capital to build your vision out together. But make sure you are transparent with partners and put everything on the table to prevent surprises from popping up. People: if you’re planning to grow you need to have the right people around you. It’s impossible to do it yourself. The stronger the team, the more trust and bandwidth you have in getting things done. That being said, leadership and guidance are key. |