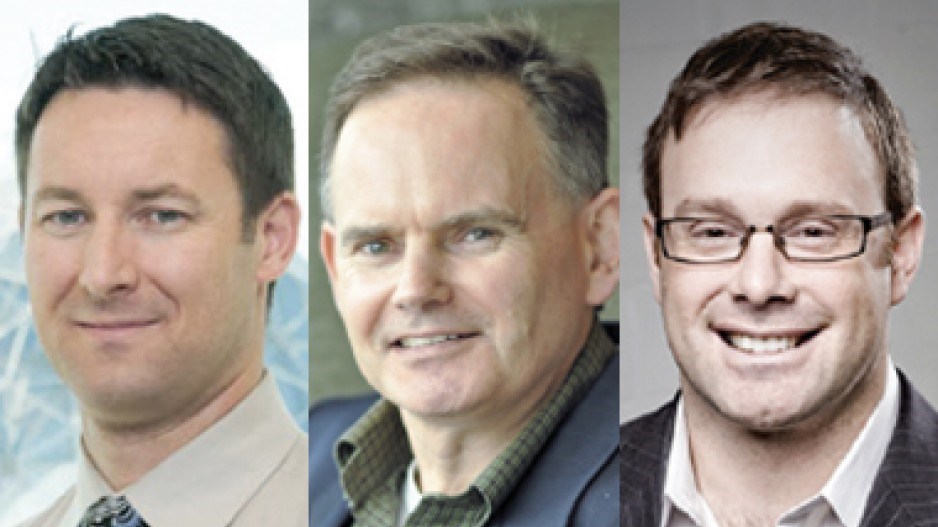

John Kirincic: Investments Manager, Vancity

Be innovative with your business, and make sure it’s an endeavour that really means something to you. Think of a great new idea (product or service), or an enhancement to something that exists, or be able to solve a big problem – particularly for a market that is in clear need and would be receptive to changing the status quo. Usually you will be expected to write a business plan or model that exhibits a clear strategy, and verify your plan with advisers and/or customers. At this stage, confidants can really help you develop critical concepts and/or expose flaws so you can tweak your plan. Don’t forget to do your research – you need to become the expert.

Create a proper business structure and plan your capital financing in advance. Proper structuring can be accomplished with the help of reputable lawyers and accountants. It’s always beneficial to lay the proper foundation upfront. Capital financing might involve your own resources, friends, family, investors (angels, strategic or financial), financial institutions, government programs, granting organizations and/or a combination of these. Remember that each financier will likely look at your business in a different light, so your approach to each one will need to be specific and sensible. More seasoned financial partners will want to see how your business will initially go to market, acquire customers and eventually scale or grow.

Be tenacious and stick to your vision. Starting a business can be the most rewarding and the most frustrating experience of your life, so be prepared. There is a lot of sacrifice along the path to success. By creating a vision and using it as a touch point, the lows and highs that inevitably happen in developing a business can be put in perspective. Your tactics and the direction of the business might change but your vision will be your guiding light.

Mark Eversfield: Market Research Analyst, Small Business BC

The most important must-have for anyone starting a business is knowing your customers. Who are they? Are their numbers growing or shrinking? Where are they located? Where do they buy? How much do they spend? How often are they spending? Are they increasing or decreasing their spending?

Another part of your customers profile is their psychographic makeup, which includes their leisure activities, media preferences, the food they eat and where they eat, the car they drive – and most importantly – their attitudes. You need to know how to communicate to them. What value-based message will get their attention?

If you don’t have this information to hand, you can use periodical resources at Small Business BC and the Vancouver Public Library or websites such as BC Stats, Statistics Canada and blocktalk.ca.

Most importantly, ask potential customers questions directly. What are their shopping preferences, online or in person, for your type of product and service? Have they purchased items like yours in the past? How important is your product or service in their lives?

The second must-have is a viable business model that includes financial information for three years. This will include all of your startup costs, fixed and variable, and your expected revenue based on your market research and your competitive advantage. If you need financing for your startup costs, there are local lending institutions such as Vancity that offer a “Be My Own Boss” loan.

Once you feel confident about your research and believe that you have a good opportunity, a final must-have is a business self-assessment such as GoForth Institute’s “Am I an Entrepreneur?” Statistics Canada has reported that the No. 1 cause of business bankruptcy was lack of management skills. Entrepreneurs are typically trying to do everything themselves. By assessing your abilities and deficiencies, you are better able to seek help where you are weakest and increase your chances of success.

Neil Belenkie: CEO, GrowthPoint Group

I firmly believe that one can accurately predict the potential success of a business if the following three criteria are met.

1) Determine your product or service

Be crushingly honest with yourself when determining if your product or service can truly generate your desired income within your desired period of time. Too often, people “believe” that they have created a solution to a common problem. Predictability is not based on belief, it is based on quantifiable data. Find out how many people have a need, how much they are willing to pay for it, and how they want the interaction to go down. Now that is a business.

2) Set goals

How much money do you want to make and within what period of time? These questions are absolutely critical. Every decision that you make will be measured against these questions; if I do x will it make me y amount of money in z period of time? Without these metrics being identified in advance, you will not be able to measure anything you do against the most important reasons you began your business in the first place.

3) Ask yourself whether you and your network are capable of building your business

What have you done in your past that gives you the confidence that you can build your business? If you don’t know how to do everything required for your business to be successful, you are going to have to learn at least a few lessons. Every lesson you learn will cost you money and time. Do you have the wisdom, strength and fortitude to be successful?