Estimated B.C. employment in May regained the ground lost in April, solidifying our view that the previous month’s plunge was more of a data blip than a severe labour market downturn.

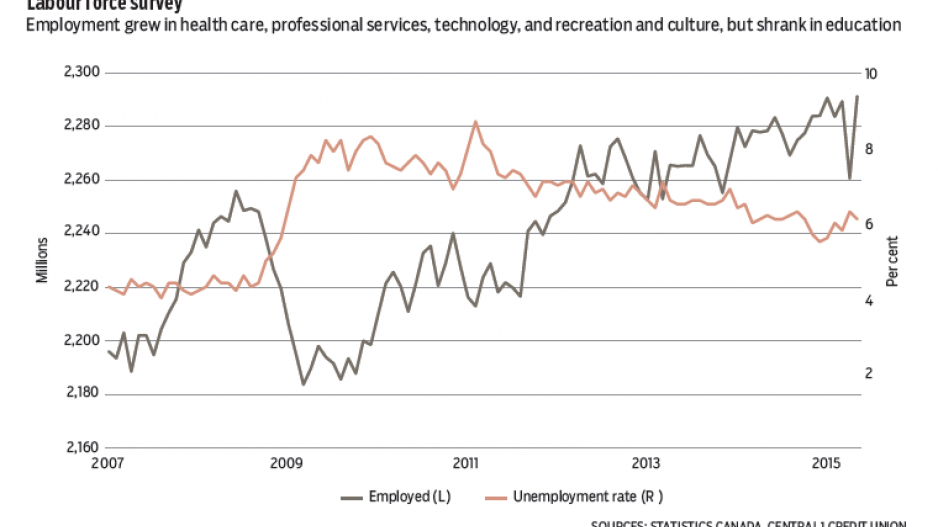

As we anticipated, provincial employment surged 1.4% or nearly 31,000 persons to 2.29 million, more than erasing the loss of 28,700 jobs in April. Growth was led by a 4.5% jump in part-time work (21,100 positions), with more modest growth in the full-time sector (0.5% or 9,600 positions). Unemployment eased to 6.1% of the labour force from 6.3%.

Among industries, sectors with the largest April pullbacks generally posted the strongest gains.

Higher employment growth was observed in professional/scientific/technical services (2.6%), information/culture/recreation (4.2%) and utilities (8.5%).

However, educational services added to April’s 5% decline with further losses in May (1.7%). Health care was an exceptionally strong performer, representing more than 40% of net monthly job gains, as employment in the sector climbed 5% or 13,400 persons.

Employment has returned to the January high, but growth remained tepid at 0.5% relative to the same month in 2014.

With the recent swings, year-to-date average employment is unchanged compared with 2014’s first five months. Full-time employment is up 2% year-to-date, but the monthly trend has deteriorated in recent months. In contrast, average year-to-date part-time employment is down 7% from a year ago, but the trend has risen.

Job quality is also a concern. Along with the full-time/part-time divide, May’s employment rebound primarily reflected growth in the self-employed workforce, rather than a retracement in private- and public-sector employment.

Self-employment is generally associated with fewer benefits and less stability. Growth in the self-employed category made up more than 80% of net monthly gains in May.

Although challenges persist in the labour market, the key lesson of the new numbers is that B.C.’s labour market is stronger than April’s figures suggested.

We expect the labour market to firm through the back half of the year, driving average annual employment growth of 0.9% and an unemployment rate of 5.7%. An improved labour market picture will dovetail with rising full-time work and a smaller share of self-employed workers. •

Bryan Yu is senior economist at Central 1 Credit Union.