That Google would be using a NASA lab to test a quantum computer developed in a low-key suburb of Vancouver might surprise more than a few of the city’s ubiquitous yoga practitioners. It’s no surprise for Time magazine, or Forbes, or Wired, or, for that matter, any of a host of technophile publications around the world. Burnaby’s D-Wave Systems, creators of the world’s first quantum computing company and makers of the computer being used by Google, has been around since 1999.

The industry is well aware that Vancouver is home to some of the world’s leading tech companies. Often referred to as Silicon Valley North, some of the city’s more famous companies include Hootsuite, Electronic Arts and Sierra Systems.

But the story of Vancouver’s tech industry, of its garage entrepreneurs and dorm-room dreamers, is only part of the picture. B.C. is booming. A WorkBC report projecting employment trends to 2025 predicts provincial economic growth of 2.2 per cent will drive employment growth at an average of 1.2 per cent per year across most sectors.

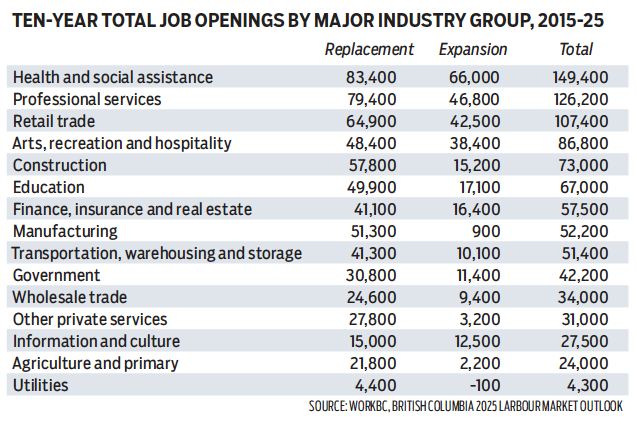

Nearly one million jobs can be expected to open up during the next 10 years with around two-thirds of them due to retirement. Eighty-nine thousand job openings are predicted for 2017, with a peak of over 97,000 job openings in 2024.

According to Statistics BC, as of September 2016 the province’s five biggest industry-sector employers were retail, health care, construction, tech services, and accommodation and food services. The WorkBC report projects the greatest growth will be seen in health and social assistance, professional services, retail trade, arts, recreation and hospitality, and construction.

The single greatest job potential is in health and social assistance, with 149,400 jobs coming available between now and 2025. Professional services, information technology and the construction sector also offer significant employment opportunities.

At least some post-secondary education and training will be required for nearly three-quarters of all job openings projected to 2025, with 42 per cent requiring at least a diploma, certificate or apprenticeship training. The second-largest group, 36 per cent, will require a bachelor’s, graduate or first professional degree, including related work experience.

Training and education are key, suggests the report, and for those with a degree, diploma or certificate, the opportunities will continue to increase. What the numbers don’t readily show, however, takes us back to the importance of technology in the provincial economy.

All economic sectors are increasingly incorporating technology into a spectrum of their operations. The rise of knowledge-based industry in B.C. has been steady since the 1960s, when the province’s biggest revenue generators – forestry, mining, transportation and the public sector – began applying tech to their operations.

For example, the B.C. Ministry of Energy, Mines and Petroleum Resources reported in 2009 that since 1980, gold production in B.C. mines had tripled while the number of industry employees working in extraction had decreased by more than two-thirds. The gold flecks in the bottom of that pan of sand reveal B.C.’s penchant for industry-specific innovation and a successful application of technology to increase productivity while decreasing overhead.

But a significant portion of industry statistics don’t capture the technological underpinnings of many of today’s business operations. The local affinity for backyard chicken coops and our penchant for all things kale may not be so simply regarded as traditional agriculture. Many modern greenhouses, among other farm processes, are run by computers. Even five years ago, a B.C. Ministry of Agriculture report showed 11,208 B.C. farms reported the use of computers for the farm business.

B.C.’s manufacturing sector, for another example, saw immense growth in 2014. A 2015 Statistics BC report showed that industry’s high-tech gross domestic product grew 8.8 per cent, due in large part to the rise of processes such as the automation of prefabricated building construction. In fact, the report showed that the province’s high-tech sector has consistently outpaced the provincial economy.

Tech industry jobs pay well here too: 66 per cent more than the B.C. average salary, higher than the Canadian tech industry as a whole, and all against a backdrop of the third-highest employment growth rate in B.C. industries between 1999 and 2012. And that means more money to spend on the many after-work activities that B.C. has on offer.