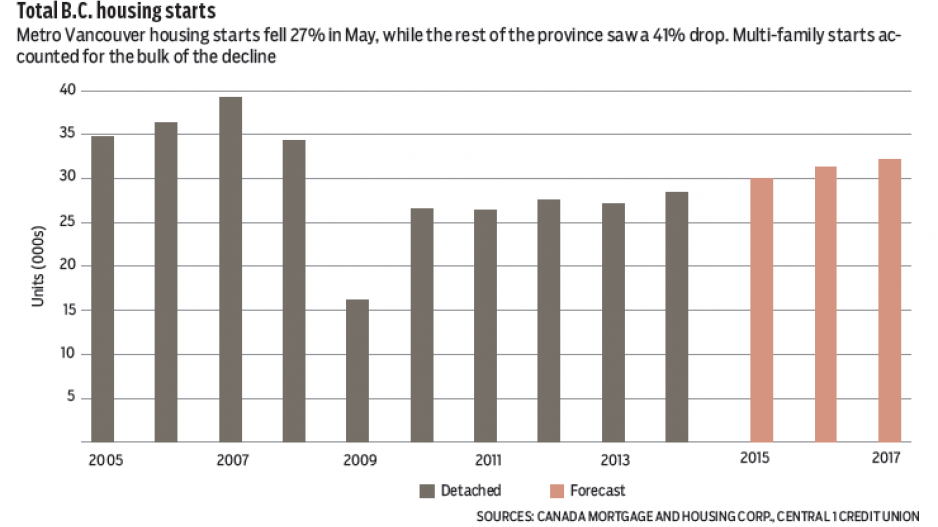

After surging to a near-seven-year high of 37,100 units in April, urban-area housing starts in B.C. fell to 25,070 units in May – down more than 30% month-to-month and 10% year-over-year.

Metro Vancouver housing starts fell 27% from April to an annualized 17,300 units, with a relatively steeper drop of 41% in the rest of B.C. Multi-family starts accounted for the bulk of the decline.

Monthly housing starts are volatile, and May’s shift below the underlying trend level of about 29,000 is not cause for concern given the uplift in recent months. Growth is being led by a doubling of starts in Victoria, Nanaimo, Prince George and Courtenay, with other markets generally holding steady from a year ago. Metro Vancouver starts are up a mild 3%. Gains are expected to narrow through the end of the year, but provincial housing starts are forecast to reach about 30,000 units, marking a 5% gain from 2014 and driving economic growth.

B.C. building intentions remained robust into April despite a sharp pullback from the near-record pace observed in March. In April, municipalities issued permits with a total seasonally adjusted value of $1.03 billion.

While permit volume fell 26% from March, with similar declines in both residential and non-residential activity, volume was up a sharp 50% from the same month in 2014 and near the upper end of the range observed since 2010. Building permit volume is prone to sharp month-to-month deviations due to the influence of large apartment projects and non-residential buildings, but levels are trending broadly higher than a year ago.

Year-to-date permit growth reached 27% through April. Gains were concentrated in the large Metro area with the exception of Abbotsford-Mission, which is down from a year ago. Residential intentions have led the gain with year-to-date growth up 34%, while non-residential activity is up a more modest 12%.

While we expect the monthly permit trend to ease back to between $900 million and $950 million, early-year activity aligns with forecasts that construction will be a growth sector for the economy this year, particularly the residential sector. The combination of modest economic growth, favourable demographics, low interest rates and lower home inventories will drive construction and renovation.

On the whole, real construction output growth is forecast to reach 3% this year before climbing above 6% in 2016 due to increased major project construction. •

Bryan Yu is senior economist at Central 1 Credit Union.