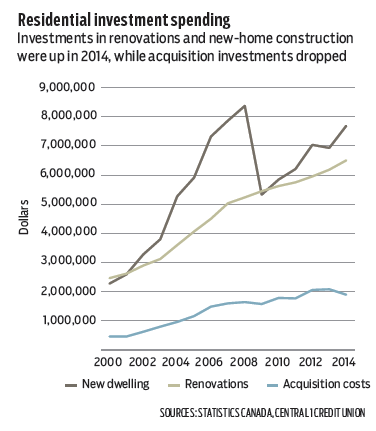

The release of fourth-quarter residential investment data confirmed our view that the housing sector was a modest contributor to provincial economic growth in 2014. Residential investment, which covers a broad spectrum of spending that includes new construction, real estate commissions, acquisition and development costs as well as renovations, trended higher in the second half of the year with fourth-quarter spending up 3% from the same quarter in 2013. Adjusted for price growth, quarterly real investment levels approached highs last observed in early 2008.

For 2014 as a whole, B.C. current-dollar residential investment climbed 5.8% from 2013 to a record $16.3 billion. After adjusting for prices, real annual growth was about 3.5%, the strongest performance since 2008.

Unsurprisingly, the gain was led by the new-home construction sector, which recorded a lift in housing starts this past year. Current-dollar investment in new buildings climbed 10.9% during the year, driven mostly by large increases in spending on single-family housing (15.9%) and multi-family buildings. Spending on townhomes was up 21%, while growth in apartment investment was a mild 3.5%. Owners of existing property also reinvested in their buildings, with renovation spending up 5.2%. Renovations typically make up 40% of total residential investment.

Unsurprisingly, the gain was led by the new-home construction sector, which recorded a lift in housing starts this past year. Current-dollar investment in new buildings climbed 10.9% during the year, driven mostly by large increases in spending on single-family housing (15.9%) and multi-family buildings. Spending on townhomes was up 21%, while growth in apartment investment was a mild 3.5%. Owners of existing property also reinvested in their buildings, with renovation spending up 5.2%. Renovations typically make up 40% of total residential investment.

Offsetting some of these gains was a surprise 8.9% drop in acquisition-related investment, which came despite a rise in real estate sales activity and housing starts. This likely reflects weaker growth in spending on apartment structures, which are typically more complex and require greater investment in development stages, as well as stronger housing market growth outside Metro Vancouver last year.

Real investment spending is forecast to average 3.5% both this year and next as low borrowing costs and modest growth drive housing demand in the province.

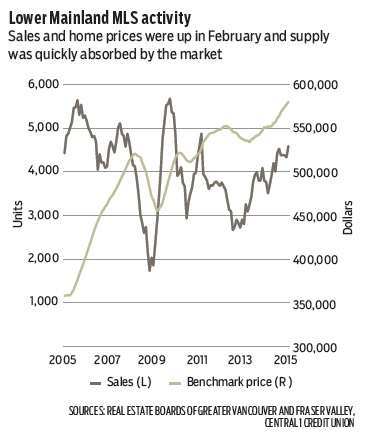

Lower Mainland home prices higher in February

Lower Mainland real estate board data is out for February and the numbers are sure to please sellers, with market conditions showing signs of heating up. Total sales activity in the area spanning Metro Vancouver and Abbotsford-Mission bumped higher to 4,590 units in February after a recent lull, and was 21% above the same month in 2014.

Sales are trending comfortably in the range observed in the mid-2000s, and while new listings popped higher during the month, the increased supply was largely absorbed by the market. •

Bryan Yu is senior economist at Central 1 Credit Union.